For UAE corporate tax purposes, taxpayers are advised to avail themselves of the services of top corporate tax consultants in Dubai to prepare for corporate tax registration and filing seamlessly. UAE Tax(levy) Consultants assist companies to stay compliant with the Federal Tax Authority’s regulations, to which noncompliance accrues hefty fines.

Several reputable Tax Consultants in Dubai are committed to furnishing effective corporate tax advisory services, strategies, and solutions.

Who is a Corporate Tax Consultant?

These sets of professionals are qualified tax and financial experts —often chartered accountants, tax law specialists, or CPAs— focused on helping companies fulfill their obligations under UAE law. Every major corporation has one, and their skills are invaluable. From tax planning and transaction structure advising to auditing support and compliance.

It’s not easy for businesses to stay up to date on all FTA regulations on their own, but these consultants help, especially in Dubai’s rapidly changing tax environment. Usually, they will assist with filings, documentation, and audits, but their main goal is to help reduce liabilities and take advantage of available incentives.

Quick idea To Top 10 Corporate Tax Consultancy in Dubai

Given table provide the quick comparison of top-10 consultancy in Dubai for corporate tax.

| Firm | Fee Range | Core Services |

|---|---|---|

| Farahat & Co | AED 10,000+ / project | Corporate tax, VAT, audit, compliance |

| CMS Middle East | Premium | Legal & tax advisory |

| Deloitte | AED 15,000+ | Corporate tax, strategy |

| Crowe Horwath | AED 8,000–25,000 | Tax planning, audit |

| EY | Premium | Tax, digital transformation |

| PwC | Premium | Corporate tax, advisory |

| KPMG | Premium | Tax compliance & planning |

| BDO | AED 8,000–25,000 | Tax & SME services |

| Grant Thornton | Moderate | Tax & growth advisory |

| Nexia International | Fees tend to vary | Tax & cross-border services |

Farahat And Co

Top Firm In Dubai since 40 years

Detail of Top-10 Corporate Tax Consultancy in Dubai

UAE corporate tax environment has been developing dramatically with the coming of Federal Decree-Law No. 47 of 2022 and the new comprehensive corporate tax regime that will come into effect on the financial year beginning on June 1, 2023. This transformation allows businesses to register, make returns and comply with new thresholds, reliefs as well as reporting requirements. Article 21 in the Small Business Relief relieves small businesses that do not have revenue amounting to higher than AED 3 million, but still has to comply with it.

The choice of the appropriate corporate tax consultancy in Dubai will guarantee the timely compliance, optimal tax planning, and lesser risk of finances. The list of the top 10 consultancies offering corporate tax service in Dubai is presented below.

1. Farahat & Co.

Farahat and Co. – Auditing Firm and TAX Consultants Location: IBIS Hotel Building, Office Entrance, 5 th floor, Office No.5001, Al Rigga Rd, Dubai, United Arab Emirates, p. +97142500251.

Unique selling point: A highly experience consultancy that suits SMEs and large companies that require individualized corporate tax services and advisory that is personally tailored.

Certifications/Awards: ISO certified, licensed auditor and controlled tax consultant in the UAE; registered with DIFC and with key free zones.

Advantages:

- UAE market experience of 35+ years.

- Extensive understanding of the UAE corporate and VAT tax regulations.

- Individual instructions and bilingual assistance of the team.

Pricing Estimate/Packages: Competitive packages starting with small assignments (estimated between $10,000 and 30,000) to full-year services (estimated between 30, 000 and 50,000).

Google Ratings + Clients: 4.6 and 100 plus reviews; 30,000 plus clients and 70 plus countries.

Most Current Achievement: Having been ranked as one of the best VAT and tax advisory firms; its service quality has been outstanding since 1985.

Address/Location: IBIS Hotel Building, Office Entrance 5 th floor, Office No.5001, Al Rigga Rd, Dubai, UAE.

Farahat And Co

Top Firm In Dubai since 40 years

2. CMS Middle East (Tax Practice -DIFC).

Unique selling point: Tax, corporate and commercial advisory firm which provides an integrated tax, corporate and commercial advice.

Certifications/ Awards: Belonging to an international network with best tax skills.

Advantages:

- Good cross-border tax structuring.

- Tax planning and legal advisory assistance.

Pricing Approxiation/Packages: Premium pricing as in global legal-tax firms; customized quotes upon demand.

Customer Rating + Clients: There are no publicly available consolidated Google rating.

Recent Achievement: Promotion of partners and expansion of UAE tax team in 2025.

Location/Address: Level 15 Burj Daman, Dubai international financial centre (DIFC), Dubai, UAE.

3. Deloitte Middle East LLC

Deloitte Address: Emaar Square Building 3, Al Mustaqbal St, Burj Khalifa – Downtown Dubai – Dubai, United Arab Emirates Telephone: +97143768888

Unique selling point: International tax strategy and corporate tax strategy company with a global-wide presence of Big-4.

Certifications/ Awards: Globally acclaimed tax knowledge and expertise in the industry with significant accolades.

Advantages:

- International network and wide knowledge in industries.

- Risk management, transfer pricing and advanced tax planning.

Pricing Estimate/Packages: Premium range (usually AED 15,000 to AED 50,000 and above per annum).

Google + Clients: Approx. 4.14.9 stars in offices in Dubai; multinational clients.

Recent Accolade: Ongoing leadership in world tax consulting surveys.

Address/Location: Emaar Square Building 3 and DIFC Office -Dubai.

4. Crowe Horwath International.

Crowe UAE (Head Office) Address: The Prism – Level 21 – Sheikh Zayed Rd – Dubai – United Arab Emirates Phone: +97144473951

Unique selling point: Mid level company that provides tax risk, tax planning, audit and custom tax services to expanding companies.

Experiences/Awards: Good foreign contacts.

Advantages:

- Custom corporate tax and compliance services.

- Pay the emphasis on practical implementation.

Pricing Approximation/Packages: Mid-range pricing (e.g., AED 8,000- AED 25,000).

Google Reviews + Clients: 4.6 out of 50 and more.

Recent Achievement: It has been acknowledged locally on the quality of client service.

Address/Location: The Prism Sheikh Zayed Rd Level 21, Dubai.

5. Ernst & Young (EY)

Ernst & Young Middle East Address: 676J +P66, Zaa beel Second -DIFC -Dubai, United Arab Emirates, Phone: +97143324000.

Unique selling point: Big-4 experience with great emphasis on corporate tax planning, compliance and digital transformation of taxation.

Awards/Certifications: Global-thought-leader in tax-advisory.

Advantages:

- Much international taxation expertise.

- New compliance devices.

Pricing Estimate/Packages: Premium (dependent on the level of the engagement).

Google Ratings + Clients: 4.7⭐ and 20+ reviews.

Latest Accolade: widespread acclaim of digital tax and advisory services.

Address/Location: Zaa’beel Second -DIFC -Dubai.

6. PwC Middle East

PwC Address: Emaar square building Ground Level – 5 floor – Burj Khalifa – Downtown Dubai – Dubai – United Arab Emirates Phone: +97143043100

Unique selling point: International Big-4 network with a reputation of providing a full-scale tax, audit, and business consultancy services.

Certifications/Awards: Repeat high ranking in global tax service.

Advantages:

- Complex corporate strategic advice.

- Effective risk and compliance standards.

Pricing Estimate/Packages: Premium range.

Google Rating + Clients: 4.6 and 170 + reviews.

Recent Success: 11-time inclusion in the FTSE Index of the world’s leading tax advisors.

Address/ Location: Emaar Square Building, Burj Khalifa Area, Dubai.

7. KPMG Middle East

The address of KPMG Lower Gulf Limited is as follows: one central, Dubai world trade centre – 4 sheikh zayed rd – trade center second – dubai – United Arab Emirates, phone: +97144030300.

Unique selling point: Big-4 company with a regional presence in terms of corporate, international transfer tax services.

Certifications/ Awards: Industry leader in the world.

Advantages:

- Extensive compliance and audit experience.

- Individualized tax planning to different industries.

Price approximation/ Packages: Premium.

Google Reviews + Customers: 4.3 stars based on 50 and more reviews.

Recent Success: Compliance structures and thought leadership in the region.

Location/Address: One central DWTC-Dubai.

8. BDO

BDO Chartered Accountants and Advisors Address: 23 rd floor Burjuman Business tower -sheikh Khalifa bin Zayed street -Dubai – United Arab Emirates -Phone: +97145186666

Unique selling point: Mid-tier consulting that is ideal to SMEs that require balanced service and price.

Certifications/Awards: Three-year-old chartered accounting network.

Advantages:

- Effective corporate tax consultancy.

- Competitive pricing.

Pricing Approximation/Packages Mid-range (AED 8,000-AED 25,000).

Google Reviews + Customers: 4.3 stars and 20 plus reviews.

Recent Success: Twelve years of custom-made SME assistance.

Location/Address: 23 rd floor -burjuman business tower-Dubai.

9. Grant Thornton

Grant Thornton Address: The offices 5, level 3, office 303 one central dubai world – trade center Second – dubai – United Arab Emirates phone: +97143889925.

Unique selling point: Mid-tier company that offers audit and tax services along with strategic growth advisory.

Certifications/Awards: Good presence on the local level.

Advantages:

- Balanced offering of SME and mid-sized companies.

Pricing/Estimate/Packages: Middle price.

Google Ratings + Customers: 4.6 and 30+ reviews.

New Success: Improved corporate tax planning services.

Address/Location: One Central Dubai World -Trade Centre.

10. Nexia International

Web Address Nexo Global Chartered Accountants Pizza Hut Building -218- Al Karama-Dubai-United Arab Emirates Phone: +971545481557

Unique selling point: Part of an international group of independent accounting firms that offer tax and advisory services.

Certifications/Awards: Member of world Nexia.

Advantages:

- International tax experience through international member firms.

Pricing Estimate/Packages: Competitive, depending on local member.

Google Ratings + Clients: Not available in the area; The international network is offered in 119 countries.

Recent Success: The ongoing international growth and the development of the professional network.

Address/Location: sheikh Zayed road, Dubai (local representative listing).

Case Study: Why Most SMEs Choose Farahat & Co Over Big-4

The 35+ years of experience in the UAE, specialized work and the approach to SMEs helps Farahat & Co stand out among the competition in the corporate tax consultancy market in Dubai.

Farahat and Co provide services unlike the Big-4 companies which usually offer extensive international services at a greater cost.

- Dedicated corporate tax services which are designed to meet the small and middle-sized enterprises rather than large multinationals.

- Clear fee systems that are within the budget of SMEs.

- Specialized professionals who direct clients on local compliance and risk reduction and optimal tax planning.

- Planning and advisory services with a focus on transparency, responsiveness and regulatory acumen.

The consequences of these factors include Farahat and Co being more accessible and affordable compared to the conventional Big-4 firms in terms of corporate tax and compliance services by SMEs.

Farahat And Co

Top Firm In Dubai since 40 years

What Does a Corporate Tax Consultant Do?

As both a navigator and a shield, their duties vary. Depending on a business’s needs at the time, its function may differ.

Generally, though, you might find a consultant helping entities:

1. File Tax Reports and Maintain Compliance

Under the amended Federal Decree-Law No. 47 of 2022, all companies must compute taxable income, file for deductibles correctly, and submit returns as stipulated. It’s not quite as easy as it seems, and that is where the consultants come into play. For multi-entity firms, it’s worse: staying compliant across all operations is harder, and consultants end up taking on that burden.

2. Tax Planning and Optimization

Beyond the basic “help a business stay compliant,” consultants create an efficient strategy that keeps the finance department running. This may include anything from advising on capital structure and the use of credits and exemptions to identifying deductible expenses.

A practical example is companies operating in free zones. These consultants create a transactional structure to help such businesses maintain a 0% corporate tax rate on qualifying income.

3. Risk Assessment and Audit Support

Imagine this: a company files a report without the help of a consultant. If the FTA audits the entity and finds errors in prior filings, penalties could be severe.

The presence of a consultant makes all the difference. No mistakes, reviews past returns, corrects discrepancies, and mitigates the risk of FTA audits catching an error. In addition to their representative services for clients in instances of investigation or compliance review.

4. International and Cross-Border Tax Advisory

Companies operating across multiple jurisdictions in the UAE or those with multinational ties need the help of consultants more than any others. The consultants guide international entities on transfer pricing, levy treaties, and global compliance.

5. Mergers & Acquisitions (M&A), Restructuring, and Transactions

This duty applies to companies undergoing a merger, acquisition, or business reorganization. The work of a consultant in such situations is to evaluate the implications on the entities involved and propose a structure to minimize liabilities.

Common Mistakes to Avoid When Hiring a Tax Consultant in Dubai

- The decision-making is based on price alone without looking at expertise, experience, and track record of compliance.

- Disregarding the local regulatory expertise, particularly when it comes to UAE-specific rules and reliefs.

- The lack of checking credentials, licensing, and registration as an official tax agent.

- Failure to vet the reviews of clients or successful cases.

- Understating the need to continue to support the services, tax compliance is an annual process.

- Assuming that corporate tax is optional; although you have a small business relief, you still have to file and report the situation

Farahat And Co

Top Firm In Dubai since 40 years

Corporate Tax Services Offering in the UAE by Top Consultant

Farahat & Co. is the leading expert in corporate levy in Dubai, UAE, offering a comprehensive range of services to cater to your corporate levy needs.

The services include:

1. Corporate Tax Advisory Services

As your trusted Corporate levy Consultants in Dubai, we evaluate the implications of Corporate levy implementation on businesses. We provide expert guidance on withholding taxes and available exemptions.

Additionally, we offer insights on corporate levy matters related to group entities, highlighting potential risks and addressing challenges faced by taxpayers.

2. Compliance Services

Our services encompass Corporate levy registration assistance and the calculation of taxable income subject to Corporate levy regulations in Dubai, UAE. We handle the meticulous computation of your tax liability and ensure the timely preparation and submission of tax returns.

3. Tax Optimization Strategies

We, as your reliable Corporate Tax Consultants, focus on optimizing your corporate levy strategy. Our seasoned professionals examine your business structure, financial transactions, and operations to pinpoint opportunities for levy savings.

Whether it’s through meticulous levy planning, the utilization of incentives, or the exploration of tax-efficient structures, we work to minimize your tax liabilities while adhering to Dubai’s tax laws.

4. Representation Services

In our representation services, we provide invaluable support to our clients. This includes preparing written submissions, responding to notices, and filing written appeals against unfavorable levy adjustments or penalties imposed by tax authorities concerning Corporate levy implementation in Dubai, UAE.

We also represent our clients directly before levy authorities, allowing them to concentrate on their core business activities.

5. Transfer Pricing Consultation

For multinational corporations operating in Dubai and Abu Dhabi, navigating the intricacies of transfer pricing is vital. Our team of experts specializes in transfer pricing regulations, ensuring you establish and maintain arm’s length pricing for transactions and agreements involving related parties and connected individuals.

We provide comprehensive documentation services to support your transfer pricing policies, ensuring compliance and reducing the risk of disputes with levy authorities.

Your Business Solution

Dubai’s Expert Advice at Your Fingertips

How to Determine Resident Persons Under UAE Corporate Tax?

➔Entities incorporated within the UAE, including Limited Liability Companies, Private Joint Stock Companies, Public Joint Stock Companies, and other UAE legal entities, are designated as Resident Persons and consequently subject to Corporate levy.

Any entity incorporated in the UAE is automatically recognized as a “Resident” Person for UAE Corporate levy. Furthermore, natural persons engaged in a Business or Business Activity within the UAE are also classified as Resident Persons for UAE Corporate levy.

In the case of foreign companies, they may attain Resident Person status for UAE Corporate levy if they are “effectively managed and controlled” within the UAE.

The assessment of where a company is effectively managed and controlled involves a comprehensive evaluation of all relevant facts and circumstances, with a pivotal factor being the location where the company’s board of directors makes strategic decisions affecting the company.

Who Are Non-resident Persons Under UAE Corporate Tax?

➔Under the provisions of the Corporate levy Law, a legal entity is categorized as a Non-Resident Person if it is incorporated in a foreign jurisdiction, and its effective management and control occur outside the UAE.

For natural persons, the designation of Non-Resident Person for UAE Corporate levy is applicable when they are not engaged in a taxable Business or Business Activity within the UAE.

Are Non-resident Persons Taxable Under UAE Corporate Tax?

➔Non-resident persons are subject to UAE Corporate levy under specific conditions, which encompass:

- On income attributed to their Permanent Establishment in the UAE.

- On income linked to a nexus within the UAE, as determined by Cabinet Decision No. 56 of 2023.

- On income sourced within the UAE is subject to a 0% Withholding levy.

How to Determine Taxable Income Under UAE Corporate Tax?

➔The calculation of taxable Income for a given levy Period relies on the net profit or loss of a business, as reported in its financial statements prepared in compliance with International Financial Reporting Standards (IFRS).

However, adjustments are necessary for specific items stipulated in the Corporate Tax Law and related implementing decisions.

These adjustments encompass unrealized gains and losses (subject to the election regarding the application of the realization principle), exempt income like qualifying dividends and capital gains, gains or losses stemming from transfers within a Qualifying Group, and deductions not allowable for Corporate Tax purposes, among others.

What Is the Relevant Tax Period Under Corporate Tax in the UAE?

➔Since Corporate levy is imposed annually, it is imperative to specify the “Tax Period.” This period corresponds to the Financial Year used for the preparation of financial statements, typically following the Gregorian calendar year (from January 1 to December 31).

However, if a business employs a different 12-month period for financial statement preparation, that specific Financial Year is considered.

What Is the UAE Corporate Tax Rate?

The applicable Corporate Tax rate is as follows:

Natural persons and juridical persons | Qualifying Free Zone Persons |

| 0% for Taxable Income up to and including AED 375,000. | 0% on Qualifying Income. |

| 9% for Taxable Income exceeding AED 375,000. | 9% on Taxable Income that is not Qualifying Income, as specified in Cabinet Decision No. 55 of 2023. |

What is the Importance of Availing the Services of UAE Tax Consultants ?

- UAE Tax Consultants provide companies with services that include corporate levy readiness, registration and filing, and ensuring compliance with the statutory tax regulations.

- Additionally, Tax Consultants in the UAE furnish expert levy advisory, corporate accounting and budgeting assistance, and corporate tax planning and consulting, to mention a few.

- Top Tax Consultants are well-versed with the prevalent Tax Laws in the UAE, which, therefore, ensures Taxable Persons stay compliant with the UAE Corporate Tax Law.

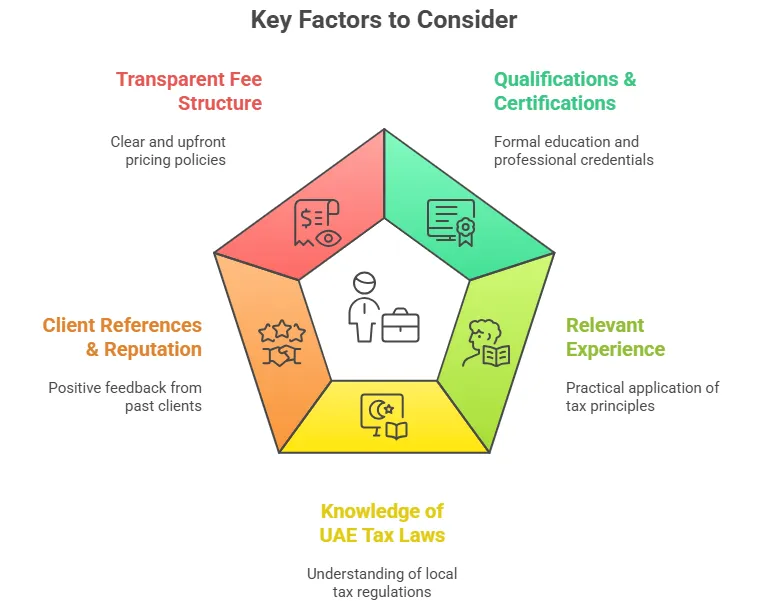

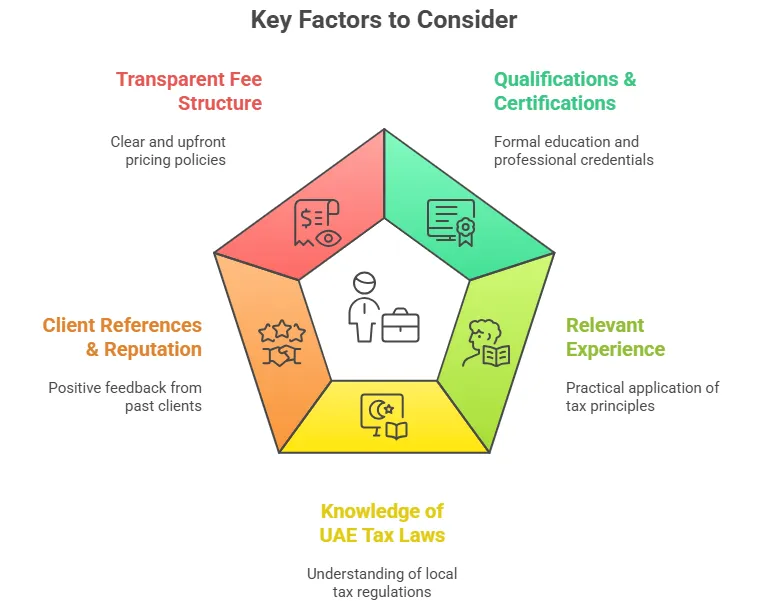

Key Factors When Choosing a Corporate Tax Consultant in Dubai ?

There are several boxes to tick off before ever choosing a consultant for your business in Dubai. It’s not enough to hire just any “professional;” the aim is to find one that actually knows the job.

So, want to hire a consultant? Consider checking:

1. Qualifications & Certifications:

In the UAE, especially Dubai, certification is everything. Look for chartered accountants or CPAs who have recognition and authorization to work across the UAE.

2. Relevant Experience:

Irrespective of the type of business, the consultant hired must have proven experience in such an industry. Never hire someone skilled in another field.

3. Knowledge of UAE Tax Laws & FTA Requirements

Every consultant hired must be familiar with current thresholds and all free zone rules. Given several changes that have occurred, such as the Corporate Tax update on June 1, 2023, ensure the consultant is up to date.

4. Client References & Reputation:

Ask for testimonials from past clients. Read up reviews from online business forums. Get feedback from other businesses the consultants have worked with, especially from the same industry.

5. Transparent Fee Structure:

A good and reliable consultant would be upfront about costs from the get-go. Whether they prefer a fixed fee, an hourly rate, or even a retainer. There are never any hidden costs.

You may also want to ask such consultants about their approach patterns, if they offer audit & compliance support, and whether their services are international (if relevant).

Who Needs Corporate Tax Services in Dubai ?

Following the aftermath of June 1, 2023, the UAE’s corporate tax regime outlined which businesses may require the services of a professional.

➔ Free zone companies that seek to maintain the 0% rate. However, this only works if they meet the strict requirements of the Qualifying Free Zone Persons (QFZPs).

➔ Mainland companies and foreign entities with branches managed in the UAE. These businesses can benefit from the 0% rate on income up to AED 375,000 and 9% above that threshold.

➔ Any business engaged in multinational transactions, M&As, or any international operations. They need the right strategies to remain compliant across jurisdictions.

➔ Startups, SMEs, and businesses in different industries (manufacturing, real estate, trade, services). These entities must assess their profits or trade activities to determine whether they fall within taxable categories.

➔ Businesses owned by non-residents and foreign entities with a Permanent Establishment (PE) in the UAE. They could be local or subsidiaries of larger corporations.

Why You Should Hire Farahat & Co. As Your Tax Consultants ?

The team at Farahat & Co. brings together expert finance and legal minds, coupled with practical experience under UAE tax laws.

By working with us, you are sure to get:

- Guidance on filings and compliance,

- Support with free zone entities and qualifying income,

- Transfer pricing and cross-border transaction advice,

- Audit preparation and representation,

- Transparent fee structure and dedicated assistance.

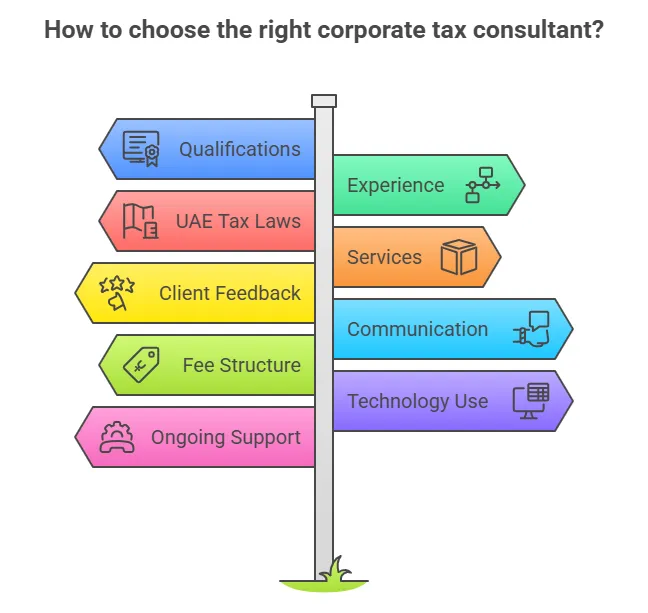

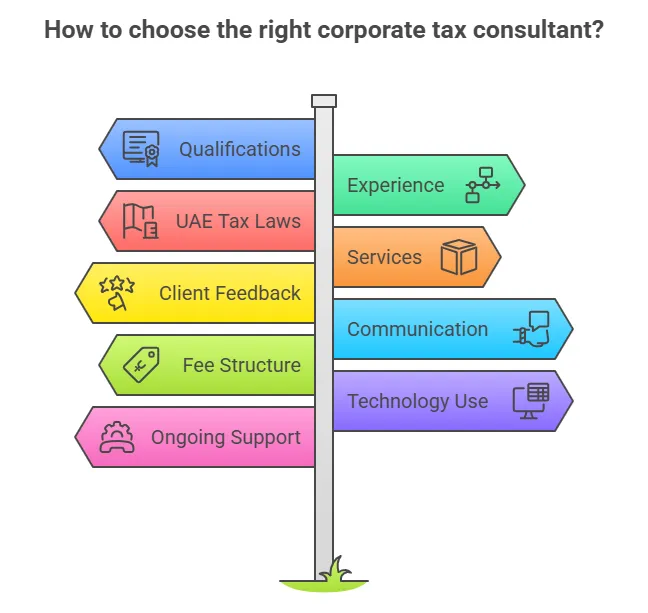

How to Choose the Right Corporate Tax Consultant?

Selecting the proper corporate tax consultant is important for tax compliance to optimize your tax strategy. This can also safeguard your business from penalties or financial risk. I the evolving tax landscape, finding a tax specialist who understands law and your industry is very important

- Check Qualifications and Certifications

Begin by checking the consultant’s professional background as an expert. Look for an expert professional qualified in accounting, taxation, or finance. Certified professionals can only understand complex tax regulations and provide proper guidance.

- Evaluate Experience and Industry Expertise

Choose a specialist who has past experience working with businesses similar to your industry. Industry-related knowledge helps them provide tailored tax planning, handle unique challenges, and they can also provide a solution.

- Knowledge of UAE Tax Laws and Recent Changes

UAE tax policies in corporate tax, VAT, and transfer pricing rules are updated regularly. An expert consultant should stay fully updated on the new FTA rules, compliance requirements, rules, and regulations.

- Explore Their Range of Services

A good corporate tax specialist should offer more than just filing support. You can check for the given services:

- Tax planning and optimization

- Corporate tax compliance

- Audit support and FTA representation

- Transfer pricing advisory

- Financial reporting assistance

- Ongoing tax strategy consultations

If a business has a large range of services, then we can assure that company.

- Review Client Feedback, References, and Reputation

You can check online reviews, ask for references, and look at testimonials. Don’t rely on only one platform; you have to check in various platforms. A consultant with a strong track record is more likely to deliver consistent and trustworthy results.

- Assess Communication Skills and Responsiveness

Your specialist must talk and listen clearly, explain issues in simple terms, and respond regularly to your questions. The best communication is needed to share the information, so you have to take care of this.

- Understand Their Fee Structure and Transparency

You have to choose those experts who can provide a visible fee structure with no extra charges. Many offices used to charge extra money for hourly, monthly, or project-based.

- Check Use of Modern Tax Technology

Efficient consultants use the latest tax software to improve accuracy, automate compliance tasks, and enhance efficiency. Latest AI technology reduces errors and ensures faster turnaround times.

- Look for Ongoing Support

Select a consultant who offers continuous guidance throughout the year. Mainly during audits, regulatory updates, or major business decisions, support is needed.

What are the Main Corporate Tax Services ?

Businesses in the UAE must comply with the UAE’s corporate tax structure. This structure includes registration, timely filings, audit readiness, and accurate assessments. Here is the given overview of the main corporate tax services that companies rely on to stay compliant and avoid penalties:

- Corporate Tax Registration

Corporate Tax Registration is the first and most crucial step for every taxable business.

- All companies, such as mainland, free zone, and certain individuals engaged in business activities. They must register with the Federal Tax Authority through the EmaraTax portal.

- If you did a successful registration, then businesses receive a Tax Registration Number (TRN), which is required for all official tax-related transactions.

- We can say that registration ensures that FTA recognizes your business, and it helps to cut the extra fines/penalties

- Corporate Tax Assessment

Corporate Tax Assessment(CTA) evaluates your tax-related income, the it can also determine the tax liability under corporate tax law.

- Consultants’ review of your financial statements, allowable deductions, and revenue streams.

- They assess applicable tax rates—such as the 0% rate for qualifying income in free zones and the 9% rate for taxable profits above AED 375,000.

- The tax assessment helps businesses identify tax-saving opportunities while ensuring full compliance with FTA guidelines.

- Corporate Tax Return Filing

All businesses must file an annual corporate tax return with the FTA.

- The return must be submitted within 9 months after the end of the financial year.

- The filing includes reporting of tax-related income, liability, deduction of declaration, and accuracy of financial details

- Specialist support to prepare for the file return to avoid fines and penalties, to ensure alignment with new tax-related rules, such as the IFRS standard and documentation.

- Proper return filing gives your business a visible compliance record and then cuts the risk of disputes with tax-related authorities.

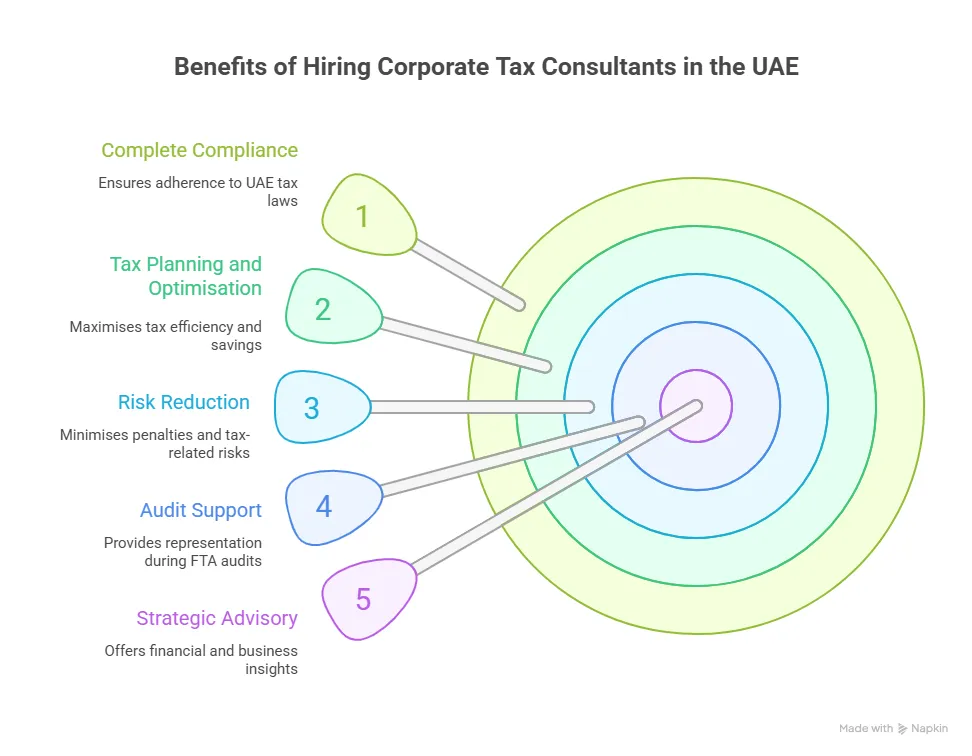

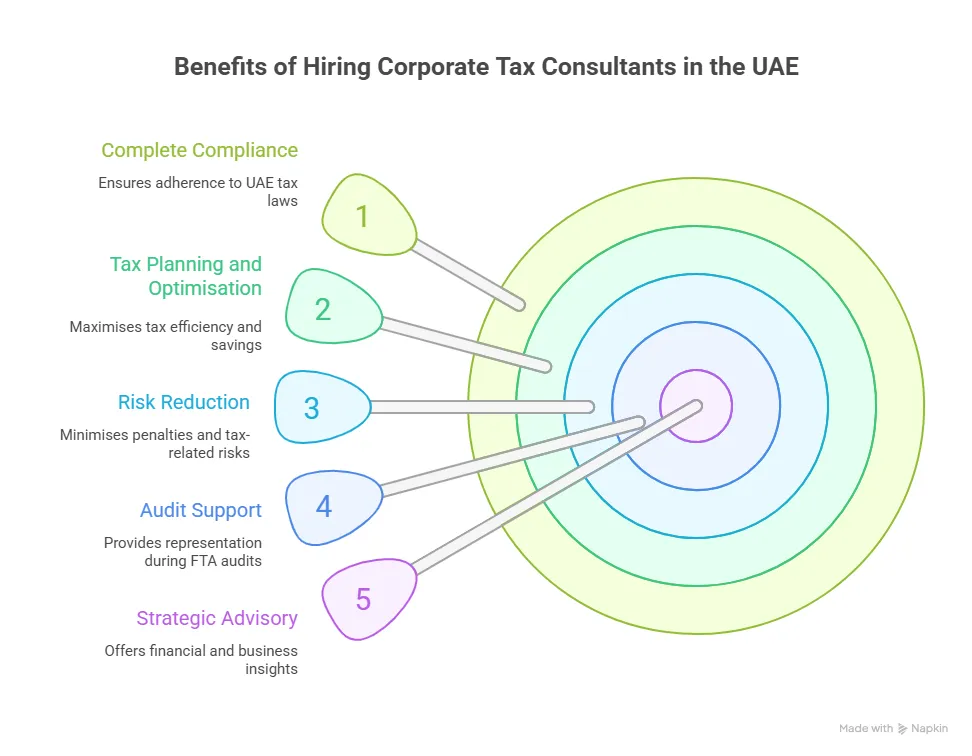

What is the Benefits of Hiring Corporate Tax Consultants ?

If you hire a tax consultant in the UAE, you provide your business with the support of an expert to navigate the tax landscape. With strict corporate tax compliance rules, a 9% corporate tax rate on taxable profits, and complex FTA requirements, professional consultants help companies stay compliant while optimising their tax position. Here are the key benefits:

Ensures Complete Compliance With UAE Tax Laws

Tax consultants are updated with the new tax laws of the UAE, with amendments, and FTA guidelines. They ensure:

- Business will meet all filing requirements

- Avoids mistakes that could result in extra fines

- Business will submit accurate documentation

This is especially important for free zone entities, mainland businesses, and companies involved in cross-border operations.

Tax Planning and Optimisation

An expert will help you legally minimize your taxable income through:

- Restructuring of business

- Managing the qualifying income

- Identifying tax-saving opportunities under UAE rules

Avoids Penalties and Reduces Tax Risks

Poor bookkeeping, incorrect filings, or late submissions can lead to severe FTA fines and penalties.

A tax specialist helps you:

- Prepare a compliant financial history.

- File taxes on time

- Reduce risks related to FTA reviews and audits

Provides FTA Audit Support and Representation

If the Federal Tax Authority starts an audit of taxes and consultants offer full support.

This includes:

- Preparing documentation

- Representing your business during the audit

- Handling FTA communication

Strategic Financial and Business Advisory

Tax consultants offer valuable insights for major business decisions, such as:

- Mergers and acquisitions

- Business expansion

- Cross-border transactions

- Transfer pricing strategies

This helps businesses grow while limiting tax exposure.

Specialized Support for Free Zone Companies

Free zone entities can maintain a 0% corporate tax rate on qualifying income—but only if they meet specific FTA conditions.

Consultants help with:

- Meeting economic substance requirements

- Managing de minimize thresholds

- Ensuring activities qualify for the 0% tax benefit Saves Time and Increases Efficiency

If you outsource tax services, then your team can focus on other core services. You can use modern tax software to increase accurate and efficient results. This can also decrease the burden of administration

What is the Corporate Tax Compliance in Dubai ?

Tax compliance in the UAE requires businesses to follow the related rules. UAE Federal Decree-Law No. 47 of 2022 is most important for this process, which introduces 9% rate for businesses having a profit of over AED 375,000.

Knowing the tax obligation for mainland or free zone business is important to avoid tax penalties and to show a good financial position

1.Understanding UAE Corporate Tax Requirements

Mainly, all businesses that earn over AED 1 million need a corporate tax in Dubai. For this process, FTA registration, bookkeeping, filing, and transfer pricing are needed.

2.Mandatory Corporate Tax Registration

Every taxable person must register with the FTA through the Emara Tax portal.

- After approval, businesses receive a TRN number.

- Even qualifying free zone entities with a potential 0% rate must register and file returns.

3.Maintaining Accurate Financial Records

Corporations should maintain detailed financial records for a minimum of 7 years.

Compliance includes:

- Following the IFRS standard or related accounting standards

- Keeping complete documentation of income, transactions, and expenses

- Being audit-ready at all times

4.Filing the Annual Corporate Tax Return

All the companies that pay tax must file a corporate tax return within 9 months after the end of every financial year.

- Failure to file the FTA tax return deadline with penalties.

- Businesses must also make their corporate tax payment by the same deadline.

Proper return filing ensures transparency and reduces compliance risks.

5.Transfer Pricing Compliance

If your organization has a party transaction, then you must follow the transfer pricing rules of the UAE, which include some principles. Compliance may require:

- Documentation transfer pricing

- master file and local file

- Disclosure forms submitted with the tax return

Following these rules prevents disputes and ensures alignment with global standards.

Free Zone Corporate Tax Compliance

While free zone companies may enjoy a 0% corporate tax rate on qualifying income, they must still comply with the general tax framework.

Key requirements include:

- Tax registration with the FTA

- Filing the corporate tax return

- Meeting economic substance requirements

- Staying within the minimum limits

- Preparing audited financial statements for QFZPs

Why Corporate Tax Compliance Matters ?

Staying compliant protects the taxation system of your business from:

- Loss of tax incentives

- Audits and disputes

- FTA penalties

- Operational disruptions

Proper compliance also supports tax-efficient planning and a strong financial reputation.

FAQ

1. What is a corporate tax consultant?

- A corporate tax consultant helps businesses manage and comply with tax laws.

2. What services are provided by corporate tax advisors?

- They offer tax registration, planning, filing, and audit support.

3. When should a company hire a corporate tax consultant?

- A company should hire one when it needs help with tax compliance or filings.

4. What is the cost of corporate tax consulting in Dubai?

- Corporate tax consulting usually costs between AED 3,000 and AED 20,000.

5. How can a small business owner benefit from a corporate tax consultant

- Small businesses benefit through accurate filings and reduced tax risks.

6. What does a corporate tax specialist do?

- They prepare tax returns and guide businesses on tax rules.

7. What are the key responsibilities of a corporate taxation advisor?

- Their key duties include compliance, documentation, and tax advice.

8. What is the primary role of a corporate tax advisor?

- Their main role is to help businesses meet tax obligations efficiently.

Reach out to us today, and our experts will help ensure your business’s finances are safe and maintain compliance.

+971 52 6922588 | Tel: +971 4 2500251 | E-mail: sales@farahatco.com