For corporate taxation in UAE, entities identified as Taxable Persons are obligated to complete corporate tax registration. This tax is imposed on a corporation’s net income or generated revenue. The regulatory framework governing corporate tax in the UAE is outlined in Federal Decree-Law No. 47 of 2022, specifying the scope, conditions, and standards for corporate tax. According to this legislation, businesses become subject to UAE Corporate Tax from the commencement of their initial financial year starting on or after June 1, 2023. Prominent Corporate Tax Consultants in UAE play a pivotal role in assisting Taxable Persons to accurately determine their tax periods, adhere to registration deadlines, and ensure compliance with the Corporate Tax Law.

Corporate Tax Registration Deadline in UAE : Financial Year June 1, 2023, to May 31, 2024

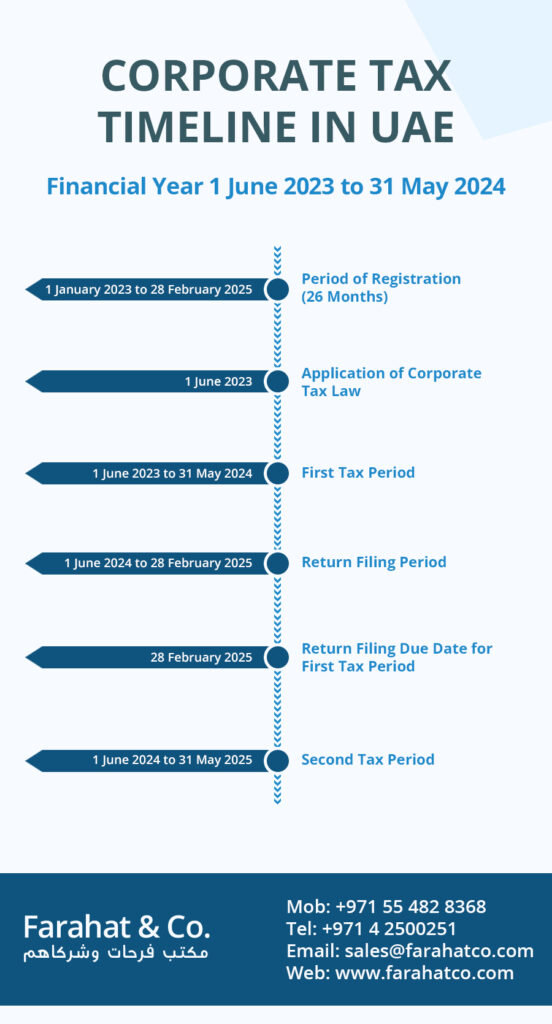

For businesses operating in the UAE during the financial year from June 1, 2023, to May 31, 2024, the following timeline must be observed:

- 2022: Corporate Tax Law Published

- January 1, 2023, to February 28, 2025: Period of Registration (26 Months)

- June 1, 2023: Application of Corporate Tax Law

- June 1, 2023, to May 31, 2024: First Tax Period

- June 1, 2024, to February 28, 2025: Return Filing Period

- February 28, 2025: Return Filing Due Date for First Tax Period

- June 1, 2024, to May 31, 2025: Second Tax Period

During this period, it is recommended that businesses proactively engage the expertise of leading Tax Consultants in the UAE well in advance. These consultants offer professional guidance to ensure all necessary documents are in order, promoting compliance with statutory regulations. This proactive approach aids in streamlining the filing process, mitigating the risk of missing deadlines and incurring fines.

Financial Year January 1, 2024, to December 31, 2024

For the subsequent fiscal year, spanning January 1, 2024, to December 31, 2024, businesses should follow this timeline:

- 2022: Corporate Tax Law Published

- January 1, 2023, to September 30, 2025: Period of Registration (33 Months)

- June 1, 2023: Application of Corporate Tax Law

- January 1, 2024, to December 31, 2024: First Tax Period

- January 1, 2025, to September 30, 2025: Return Filing Period

- September 30, 2025: Return Filing Due Date for First Tax Period

- January 1, 2025, to December 31, 2025: Second Tax Period

During this phase, businesses can leverage their initial filing experience to establish robust accounting practices, maintaining accurate records throughout the year. This diligence significantly contributes to streamlining the tax filing process.

Financial Year April 1, 2024, to March 31, 2025

For the third fiscal year under the new tax regime, spanning April 1, 2024, to March 31, 2025, the following timeline is applicable:

- 2022: Corporate Tax Law Published

- January 1, 2023, to December 31, 2025: Period of Registration (24 Months)

- June 1, 2023: Application of Corporate Tax Law

- April 1, 2024, to March 31, 2025: First Tax Period

- April 1, 2025, to December 31, 2025: Return Filing Period

- December 31, 2025: Return Filing Due Date for First Tax Period

- April 1, 2025, to March 31, 2026: Second Tax Period

By this point, businesses should have a solid understanding of the tax filing process. However, staying informed about updates or changes in tax regulations is crucial to ensuring continued compliance with UAE tax laws.

Corporate Tax Registration Deadline in 2024:

| Deadline for License Issuance regardless of year of issuance | Deadline for Corporate Tax Registration |

| 1 January to 31 January | 31 May 2024 |

| 1 February to 28/29 February | 31 May 2024 |

| 1 March to 31 March | 30 June 2024 |

| 1 April to 30 April | 30 June 2024 |

| 1 May to 31 May | 31 July 2024 |

| 1 June to 30 June | 31 August 2024 |

| 1 July to 31 July | 30 September 2024 |

| 1 August to 31 August | 31 October 2024 |

| 1 September to 30 September | 31 October 2024 |

| 1 October to 31 October | 30 November 2024 |

| 1 November to 31 November | 30 November 2024 |

| 1 December to 31 December | 31 December 2024 |

Consequences of Missing Tax Return Deadlines

Adhering to the prescribed timelines for corporate tax filing in the UAE is an essential regulatory requirement, integral to maintaining a stable business environment. Failure to meet these deadlines can result in severe consequences:

- Penalties and Fines: Significant penalties are imposed for late filing, accruing daily until the return is submitted.

- Loss of Good Standing: Non-compliance can lead to a loss of good standing with tax authorities, impacting a company’s reputation and business effectiveness.

- Legal Ramifications: Non-compliance may lead to legal action, including license suspension or revocation, disrupting business operations.

- Reputational Damage: Late or non-compliance can tarnish a company’s reputation, affecting trust among stakeholders.

- Audits and Scrutiny: Non-compliance may subject companies to rigorous audits and scrutiny, consuming valuable resources.

- Cash Flow Constraints: Penalties and fines can impose financial burdens, affecting cash flow and investment capabilities.

Seek the Expert Services of Top Tax Consultants in UAE

To effectively determine tax periods and ensure compliance with the Corporate Tax Law, engaging the services of Top Tax Consultants in UAE is advisable. These consultants are dedicated to providing professional corporate tax advisory services. Contact us today, and we will be pleased to assist you.

Read More: A Guide to Corporate Tax Deregistration Under The UAE Corporate Tax Regime

Frequently Asked Questions

Who will be required to register for UAE Corporate Tax?

All Taxable Persons must register for UAE Corporate Tax and obtain a Corporate Tax Registration Number. Non-resident persons earning State Sourced Income without a Permanent Establishment in the UAE are exempt.

When do I register for UAE Corporate Tax?

All Taxable Persons must register before filing their first Corporate Tax Return. The Federal Tax Authority may register a Taxable Person, who is not otherwise registered, at their discretion.

Is there a registration threshold for UAE Corporate Tax?

There is no registration threshold for UAE Corporate Tax. All Taxable Persons, regardless of their tax liability, must register.

How do I register for UAE Corporate Tax?

Taxable Persons can electronically register through the EmaraTax Portal.

I am already registered for VAT purposes. Do I have to register for UAE Corporate Tax?

Yes, Taxable Persons must register for UAE Corporate Tax, even if already registered for VAT.

Will businesses be required to register for Corporate Tax if they are exempt from Corporate Tax or have no tax liability?

Yes, all Taxable Persons, including those with no Corporate Tax liability, must register. Certain entities can apply for exemption after registration.

Under what circumstances can a business deregister for Corporate Tax?

A business can apply to deregister if it ceases to conduct its business or ceases to exist, provided all Tax Returns and liabilities are settled.