Financial transparency and compliance has always been of critical importance in the Fast-evolving business landscape of Dubai. Partnering with a professional audit firm is always a good idea when it comes to ensuring compliance with the fast changing laws of the business in UAE. Farahat & Co. is one company that is aware of the special issues businesses face in the UAE. We aim at assisting the companies to maneuver through the regulations of UAE, to be compliant with IFRS (International Financial Reporting Standards) and to be financially upright in every part of their operations. So, whether you are a startup, a multinational company of you have an existing business, financial audit and internal controls are a must to check for.

Farahat And Co

Top Audit Firm In Dubai since 40 years

Top-10 Audit Firms in Dubai 2026?

This table lists top audit firms in Dubai, detailing their year established, key services offered, and unique distinguishing features.

| Audit Firm | Fee Range | Key Services | Unique Features |

| 1. Farahat & Co | Low–Medium | Auditing, VAT consulting, excise tax, accounting, corporate tax advisory, company liquidation | Deep UAE market knowledge, strategic and tailored solutions, high-quality and timely services |

| 2. Deloitte | High | Audit, taxation, financial advisory | One of the Big 4, offers statutory, operational, compliance, and financial audits |

| 3. KPMG | High | Audit, advisory, taxation (local and international), consultancy | Operates in 155 countries; expertise in financial, healthcare, infrastructure, industrial, and technology |

| 4. BDO (Binder Dijker Otte) | High | Accounting and auditing | Presence in 162 countries, innovation, adaptable approach |

| 5. Ernst & Young (EY) | High | Audit, assurance, transactions, advisory | 61+ partners, 1106 employees in Dubai; values of respect, integrity, and professionalism |

| 6. PricewaterhouseCoopers LLP (PWC) | High | Audit, assurance, financial advisory, tech-powered experiences | Bold ideas, human-centric solutions, second-largest professional services network |

| 7. Grant Thornton | Medium | Audit, accounting, advisory | Ranked 7th-largest globally; focus on quality, innovation, and expertise |

| 8. Baker Tilly | Low | Assurance, advisory, consultancy | Network of 30 offices in the Middle East and Africa, accessibility and reliability |

| 9. Crowe Horwath Chartered Accountants | Medium | Audit, tax services, consulting | Builds long-standing client relationships |

| 10. A&A Associate LLC | Medium | Audit, tax, business consultancy | Personalized solutions for clients; top 10 audit firms in UAE |

Dubai is a global business hub. The selection of the right audit partner in such a competitive place is important. It doesn’t matter how big or small your company is, the right audit firm is key. An experienced audit firm allows your company to follow the legal rules and also maintain financial credibility. The top 10 leading firms operating in Dubai are:

List of Top-10 audit firms in Dubai 2026

1.Farahat & Co, Al Rigga Road, Dubai

Established in 1985, Farahat & Co has earned an immense reputation as a leading audit firm in Dubai. With expertise spanning a wide range of services including auditing, VAT consulting, excise tax, accounting, corporate tax advisory, and company liquidation, our team brings in-depth knowledge of the UAE market. We are committed to offering strategic and tailored insights that deliver results that meet your unique business needs.

At Farahat & Co., we pride ourselves on providing high-quality, timely services and solutions.

USP (Unique Selling Point):Farahat & Co is best for SMEs, real estate companies, and family-owned businesses that require fast, compliant, and cost-effective audit and corporate tax services in Dubai.

Certifications, Awards & Accreditations

- Registered Auditor with UAE authorities

- Approved Tax Agent with the Federal Tax Authority (FTA)

- ISO-aligned internal quality controls

- Member-associated professionals from ACCA and CPA bodies

Advantages

- Strong focus on UAE Corporate Tax advisory

- Faster turnaround than Big-4 firms

- Dedicated partner involvement

- Industry-specific audit teams (real estate, trading, construction)

Pricing Estimate / Packages

- SMEs: AED 6,000 – 15,000

- Mid-size companies: AED 15,000 – 35,000

Google Ratings & Client Base

- Rating range: 4.7★–4.9★

- 3,000+ regional clients (SMEs and mid-market)

Recent Achievement: Expanded Corporate Tax structuring and advisory services post-2023 tax implementation

Address / Location: Deira & Business Bay, Dubai, UAE

Farahat And Co

Top Audit Firm In Dubai since 40 years

2. Deloitte Middle East, Audit Firm in Downtown Dubai

Founded as early as 1845 in London (UK), Deloitte is highly recognized and is regarded as one of the big 4 internal and external audit firms. It provides trustworthy services such as audit, taxation, and financial advisory. It is one of the biggest audit companies and the biggest recruiter of finance professionals.

The following are the types of audits Deloitte provides to its clients:

- Statutory audits, special purpose, and limited scope audits

- Operational audits

- Financial investigation and restructuring assistance

- Review

- Compliance auditing

USP (Unique Selling Point):Best suited for large multinational corporations and complex cross-border audits.

Certifications & Accreditations

- Big-4 global network

- IFRS, SOX, and international tax leadership

Advantages

- Global methodologies

- Advanced analytics and risk advisory

- Strong regulatory reputation

Pricing Estimate: AED 60,000 – 250,000+

Google Ratings & Clients

- 4.3★–4.6★

- Thousands of global enterprise clients

Recent Achievement: Corporate tax transformation frameworks for GCC entities²

Location: DIFC, Dubai

3. PwC Middle East, Audit Firm in Downtown Dubai

PricewaterhouseCoopers (PWC) is considered one of the Big 4 audit firms, from Deloitte, KPMG, and EY. It operates under the PWC brand and currently ranks as the second-largest professional network services firm.

It prides itself on its philosophy of delivering bold ideas, human-centric solutions, and tech-powered experiences that deliver lasting results to organizations, customers, and communities.

USP (Unique Selling Point): Preferred by listed companies and financial institutions.

Accreditations

- Big-4 firm

- IFRS & global assurance leader

Advantages

- Strong risk and compliance advisory

- Technology-driven audit processes

Pricing: AED 55,000 – 220,000+

Google Ratings: 4.4★ approx.

Recent Achievement: UAE Corporate Tax Readiness Programs

Location: DIFC, Dubai

4.KPMG Lower Gulf, Audit Firm in Dubai (World Trade Centre)

Founded in 1987, KPMG is yet another audit firm with an outstanding brand image amongst customers. It has a wide base for providing services to 155 countries and includes versatility in its divisions from auditing, advisory, and taxation (both local and international) to consultancy services.

KPMG has carried out audits for a multitude of sectors such as:

- Financial

- Government, healthcare, and infrastructure

- Industrial and consumer markets

- Technology, telecommunications, and media

USP (Unique Selling Point): This makes it a superior choice for regulated sectors such as banks, insurance, and energy.

Accreditations

- Part of the Big 4 firm

- Works on the global IFRS and ESG audit framework

Advantages

- Higher experience in sector-specific work

- The internal control reviews are excellent.

Pricing: The price range could be slightly expensive at AED 50,000-200,000.

Recent Achievement: Recent works on ESG and sustainability audit expansion

Location:The office is located at DIFC, Dubai

5. Ernst & Young (EY) , Audit Firm in Dubai ,DIFC

EY is a global leader in audit, assurance, transactions, and advisory services. With a large team of 61+ partners and 1106 employees in Dubai from diverse cultures, EY conducts business keeping in mind its values of respect, work integrity, and professionalism.

USP (Unique Selling Point): A better audit option for high-growth enterprises and IPO-ready companies

Accreditations

- Part of the Big 4 firms

- A leader in assurance and global tax

Advantages

- Performs strategic tax planning for its clients

- It has a strong transaction advisory feature

Pricing: The fees range higher, between AED 55,000 and 210,000.

Location: Similar to other Big 4, Ernst and Young is located in DIFC, Dubai

6. Grant Thornton UAE, Audit Firm in Dubai (DWTC)

An American member organization of Grant Thornton International, Grant Thornton is currently ranked as the seventh-largest accounting, audit, and advisory firm in the world.

Its objective is simple- delivering quality, innovation, and expertise that clients all over the world can rely on.

USP (Unique Selling Point): Grant Thornton specialises in working for mid-sized companies, between SMEs and large firms.

Accreditations: Part of the top 10 Global audit network

Advantages

- The approach to work is practical and advisory

- Pricing for Grant Thornton is competitive

Pricing: The fees range between AED 20,000 and 70,000.

Location: Sheikh Zayed Road, Dubai

7. BDO (Binder Dijker Otte),Audit Firm in Burjuman Business Tower

Since 1963, BDO has been considered the best audit firm consisting of a wide client base from 162 countries worldwide. With its expertise, certified auditing team, innovation, and adaptable approach, it aims to consistently provide its clients with the best growth in the competitive market of UAE with its accounting and auditing services.

USP (Unique Selling Point): BDO UAE specialises in family businesses and regional groups

Advantages

- The engagement with BDO is always partner-led

- The tax compliance support provided by BDO is outstanding.

Pricing: Its competitive fees remain between AED 25,000 and 90,000

Location: The office for BDO lies in Dubai and Abu Dhabi

8. Crowe UAE, Audit Firm in Dubai (Business Bay)

Crowe Horwath is a recognized name amongst top audit firms in Dubai, UAE. They offer an extensive range of services such as;

- Audit

- Top-notch Tax services

- Consulting

It mainly focuses on building long-standing associations with clients that enhance their status among the top audit firms in Dubai, UAE.

USP (Unique Selling Point): This firm is better known for advisory services and international structuring.

Advantages

- It has a strong forensic audit team

- The international tax exposure for Crowe is brilliant.

Pricing: The pricing ranges between AED 20,000 and 80,000

Location: The location of its company is at DIFC, Dubai

9. RSM UAE, Audit Firm in Dubai (Business Bay)

USP (Unique Selling Point): The focus is mainly on entrepreneurial and fast-growing companies.

Advantages

- The working models for RSM are generally SME friendly

- The compliance support is its biggest advantage

Pricing: The price ranges between AED 18000 and 65000

Location: The location of the company is Dubai and Sharjah

10. Baker Tilly Middle East, Audit Firm in Dubai World Trade Centre

Baker Tilly is a well-respected professional audit firm based in Dubai, known for its comprehensive range of services. Their offerings include assurance, advisory, and consultancy services, catering to a wide array of client needs. What sets Baker Tilly apart is not just the quality of their services but also their extensive presence.

With a network of 30 offices spread across the Middle East and Africa, they have built a strong reputation for accessibility and reliability. This widespread footprint allows them to serve clients in diverse regions, ensuring that they are always close by, no matter how far away.

USP (Unique Selling Point): Firms looking for cost-controlled audits with international standards can contact Baker Tilly in Middle East

Advantages

- Value-based pricing

- Strong internal audit services

Pricing: AED 15,000 – 60,000

Location: Dubai

Farahat And Co

Top Audit Firm In Dubai since 40 years

Case Study: Why Most SMEs Choose Farahat & Co Over Big-4 Firms ?

It is common to ask why one should choose Farhat and Co. over the big firms present in the market. Well the answer is simple. Farahat and Co. has over 35 years of experience in the consulting business. We have been working closely with clients in Dubai.

Similarly, the knowledge of corporate tax, audit, and regulatory compliance is brilliant at Farahat and Co. With recent changes in the law, it is clear that firms look for local expertise, direct partner access, and transparent pricing. All of this is provided by Farahat and Co.

What Makes Farahat & Co. Unique?

There are many readers and business owners who might question why Farhat and Co. is unique. Well, the answer is simple. Farhat and Co. is unique mainly for the quality of work and the grip we have on the local market. Along with that, proper planning before an audit for record time to complete also makes it special.

Other unique features of Farhat and Co., which refer to choosing this company, are:

- No hidden costs with fixed fee structures

- Different audit teams for different industries

- Special unit for corporate tax registration, filing, and advisory

- Quicker and dependable work delivery

- The team has a comprehensive understanding of both mainland and free zone rules in the UAE.

Common Mistakes to Avoid When Hiring an Auditor in Dubai

The value of a right auditor is massive in the recent business environment of the UAE. Firms have been increasingly knowledgeable about the requirements of the right audit firm. But there are some who still make the mistake of choosing the wrong firm.

There are some common mistakes that need to be avoided before hiring an auditor. They are:

- Select an audit firm based on industry experience

- Never ignore the ability of the UAE corporate tax advisory

- Always verify FTA registration and auditor licensing

- Put a key focus on partner involvement and turnaround

Farahat And Co

Top Audit Firm In Dubai since 40 years

How To Select Best Audit Firm In Dubai ?

Audit firms are not created equal. When choosing a firm, take into consideration:

➔Skills and Background: Make sure that they have had experience in dealing with your kind of business be it a start up, SME or a multinational firm.

➔Industry Knowledge: Professionals that are conversant with your industry are aware of the issues and compliance needs that are particular to your industry.

➔Customized Services: A company is supposed to provide business specific solutions as opposed to generic packages.

➔Regulatory Compliance: Enforce that the firm maintains a high level of compliance to the regulatory standards in the UAE and global accounting standards.

➔Risk Management: Good audit firms take the initiative of identifying risks and offering solutions to reduce them. We identify local knowledge and global best practices in Farahat & Co., to ensure that the business reduces risk, ensures compliance, and makes informed financial decision making.

Why Auditing is Essential for Businesses ?

The regulatory environment of the UAE is strict and when your business is the subject of appropriate auditing, you will be guaranteed protection. With the help of an experienced audit firm, you are assisted in:

➔ Comply with the requirements of the Federal Tax Authority (FTA) and other local regulations.

➔ Carry out proper financial audits to ascertain accounts and statements.

➔ Enhance internal controls as a way of reducing risk.

➔ Make sure that there is transparency of financials to increase investor and stakeholder confidence.

➔ Automate the accounting processes to conserve resources and time.

Whether it is a startup or an international corporation, professional auditors are available to provide the skills and knowledge necessary to deal with the intricacies of business work in the city of Dubai.

List Services leading auditing firms provide

It is a fact that the major audit companies such as Farahat & Co. offer customized services to their clients according to the specific needs of the client. These include:

- Financial Audits: Making sure that your financial statements are prepared in accordance with the IFRS and are presented as your real business.

- Internal Controls Assessment: This is the assessment of the systems and processes to avoid errors or fraud.

- Tax Compliance Support: FTA reporting and VAT compliance.

- Accounting Services: Ranging between the bookkeeping services and the financial reporting services, the smooth running of business.

- Consulting Services: Expert advice to enhance performance, risk, and operations.

Hiring the appropriate audit firm does not just start and finish with compliance, but is also a positive move towards a sustainable business growth.

Farahat And Co

Top Audit Firm In Dubai since 40 years

Which Industry Is Mandatory for Audit Services ?

Certain industries in Dubai must go through the auditing services. It is due to the regulatory, legal, or stakeholder requirements.

- Financial Sector: Banks, insurance companies, and financial service firms must regularly be audited. The Central Bank of the UAE and the Securities and Commodities Authority are mainly involved in it.

- Real Estate: Auditing must be done by developers, property management companies, owners’ associations and escrow account agents. These agents must fall under RERA and DLD guidelines.

- Listed Companies: Companies that are listed on the stock exchange, such as the Dubai Financial Market, must have audited financial statements.

- Free-Zone Entities: The industry that is within DIFC, regulated by DFSA or under DDA, must do auditing for license or regulatory reporting

- Government-Related Entities: Public funds, government-owned entities, and other government bodies must perform auditing under the Financial Audit Authority.

Why to Choose Top Audit Firms for Your Business ?

There are different advantages of choosing top audit firms:

- Credibility & Trust: Top audit firms like Big 4 help you to win the confidence of the stakeholders.

- Technical Expertise: These experienced firms understand IFRS, local accounting standards, along with required industry regulations.

- Risk Management: They provide risk-based audit and management letters. This helps you to identify and minimise the business risk.

- Value-added Advice: Not only audit, but they also provide tax planning, business process improvement, forensic accounting, cybersecurity, and data analytics.

- Scalability & Global Reach: If you have international operations, a top audit firm allows you to work with cross-border expertise and global networks.

- Regulatory Compliance: Working with top auditors like CA firms in the UAE allows for compliance with approved auditors in the UAE. This helps in license extension for mainland and free zone companies.

How to Choose the Right Auditors in Dubai ?

Following are the major factors that each business should consider before finalizing its auditing partner. Explained in simple, helpful language.

Qualifications of the Audit Professionals

Work only with auditors who hold internationally recognized certifications such as

Certified Public Accountant (CPA), Chartered Accountant (CA), Association of Chartered Certified Accountants (ACCA) or Certified Internal Auditor (CIA).

These qualifications ensure that the auditor understands IFRS, UAE regulations, and global auditing standards.

Registration and Licensing

The audit firms should be registered auditors in Dubai and need to be approved by the DED or by the relevant free zone authorities.

A licensed auditor ensures that your reports are accepted by banks, investors, and government bodies.

Experience with your business structure

Choose a firm experienced in the type of company you operate:

- Mainland DED companies

- DMCC, DAFZA, JAFZA entities

- Offshore companies

- SME enterprises

- corporate groups

Industry experience ensures that audit work is accurate and in compliance.

Utilization of Modern Auditing Tools

Advanced auditing technologies, automation tools, and digital working papers are being used by the leading audit companies in Dubai.

It increases accuracy, reduces manual errors, and speeds up the timeline in auditing.

Communication Style & Reporting Quality

The audit report should be:

- Clear

- Action-oriented

- Easy to understand

- Delivered on time

A good auditing firm needs to maintain clear communication, regular updates, and professional advisory support.

Fee Structure and Contract Terms

Reliable auditors will have straightforward pricing with no hidden costs.

Firms that offer very cheap audits are to be avoided, as they always compromise either on quality or on compliance.

Advisory Services Added

Most companies in Dubai would prefer companies offering additional services such as:

- Consultation on VAT

- Consultation on company taxes

- Risk management

- Accounting support

This grants continuity and accuracy to all functions of finance.

Farahat And Co

Top Audit Firm In Dubai since 40 years

What are the Key Evaluation Criteria Audit Firms Ranking ?

Most “rankings” differ online because there’s no single government-issued list.

However, the auditing industry commonly grades firms on the basis of the following standardized and transparent criteria:

Regulatory Compliance & Approvals

Top companies continuously comply with:

- UAE Ministry of Economy requirements

- Free zone approvals: DMCC, DAFZA, JAFZA

- Local auditor registration rules

Those firms that fail compliance cannot be ranked at the top.

Audit Quality & Technical Expertise

Key quality indicators:

- Experience with IFRS

- Strong internal review procedures

- Ability to conduct complex audits: groups, multinationals, consolidation.

- Expertise in the following industries: real estate, construction, trading, healthcare, retail, and technology.

Technological Capability

High-ranking firms apply:

- Automated audit tools

- Data analytics

- Digital evidence collection

- Cloud audit software

Technology enhances audit quality by reducing human errors.

Ethical Standards & Independence

Reliable firms have:

- Strict independence rules

- No conflict of interest.

- Transparent fee structure

- Confidentiality guarantees

It is good ethics that ensure trustworthiness.

Risk Management Practices

Strong internal controls of risk reduce

- Auditing errors

- Legal exposure

- Misstatements

- Reputation risks

This is a major ranking factor globally, and also within the UAE.

Customer Retention & Reputation

Rankings are based on:

- Long-term client relationships

- Corporate and SME customer feedback

- Online and offline testimonials

- Referrals from banks, lenders, and governments

High retention = reliable performance.

Industry-Specific Teams

Large auditing firms have separate teams for different industries including:

- Free Zone companies

- Retail

- Contracting

- Logistics

- Hospitality

- Professional services

Industry knowledge ensures relevant and effective audits.

Scope of Services

With full-scope capability, extended service firm offerings in tax, advisory, accounting, and VAT receive more favorable ratings.

Why we Need of Registered Audit Firm?

Following the Law: Working with registered auditors helps you follow the rules and report what the UAE authorities want you to do.

- Financial Accuracy and Openness: If you hire an approved auditor, it will be easier to keep your finances accurate and build trust.

- Regulatory Reporting: Banks, free zones, and real estate trusts receive the financial statements that the registered firm gives them.

- Risk Management: It is easy to identify the weaknesses, inefficiencies, and potential fraud with the help of registered firms.

- Business Reputation & Investor Confidence: If you hire registered audit firms, your clients will trust your company.

- Legal Penalties: An unregistered auditor could harm your company’s reputation. You would have to pay fines, and suspension of the license can also happen. Based on the Commercial Companies Federal Law No. 32, you aren’t allowed to renew your business license either.

- Corporate Governance: Auditing services provided by registered firms strengthen the governance structure and also help in better decision-making.

Farahat And Co

Top Audit Firm In Dubai since 40 years

Difference between Farahat & Co. Vs Other audit firm ?

Here’s a comparison table showing how Farahat & Co stacks up against other top audit firms in Dubai.

| Feature | Farahat & Co | Other Top Audit Firms (e.g., Big 4, Grant Thornton, BDO) |

|---|---|---|

| Services Offered | We offer services like audit & assurance, VAT consulting, corporate tax advisory, company liquidation, and accounting. | Statutory audit, internal audit, risk advisory, tax advisory, M&A, data analytics. |

| Experience & Industry Focus | It is a local firm with a deep understanding of the UAE market and freezone and mainland SMEs | They have a global presence, expertise across financial services, real estate, health care, etc. |

| Pricing Tier | The pricing remains at mid to high levels with competitive local rates and customised services. | The price remains on the higher side with global reach. |

| Client Reviews & Reputation | It is well established in the UAE market with trust from local businesses. | Big Four firms are globally recognized; mid-tier firms are praised for client-centric services. |

| Years of Service | Since 1985, decades of local presence. | Big Four: historically global firms; other regional players also have long track records. |

What is the Benefits of Hiring an Audit Firm ?

- Accounting audits are an integral aspect to consider for a business to conduct both locally and internationally. Getting an audit from top audit firms in Dubai can provide you with the necessary know-how and oversight on your company’s financial position as well as help to convince potential partners and shareholders.

- Dubai is one of the most dynamic and diverse business hubs in the world, attracting investors and entrepreneurs from various sectors and industries. With its strategic location, tax-free environment, and world-class infrastructure, Dubai offers a conducive and competitive platform for business growth and development

- A fundamental legal requirement for businesses in the UAE is the auditing of accounts and the strong maintenance of finances. To meet this need, a large number of options are available although merely choosing one based on brand recognition is common and oftentimes the number 1 mistake companies make.

Why Choose Farahat & Co for Audit Services in Dubai ?

Farahat & Co. is licensed by the Ministry of Economy in the United Arab Emirates and fully complies with Federal Law No. 2 of 2015 and Federal Decree-Law No. 32 of 2021 related to Commercial Companies.

The team is comprised of highly experienced Chartered Accountants, CPAs, and certified professionals trained in the delivery of quality statutory audits, external audits, internal audits, forensic audits, tax audits, VAT audits, and many others.

We are committed to International Financial Reporting Standards, ensuring each report is accurate, compliant, and accepted by:

- Banks

- Government agencies

- Investors

- Free zones authorities

- DED

Farahat & Co.’s advisory support encompasses:

- Corporate taxes

- VAT compliance

- Strata auditing

- Sales auditing

- Business setup

- Internal Control Enhancement

- Assessment of Financial Health

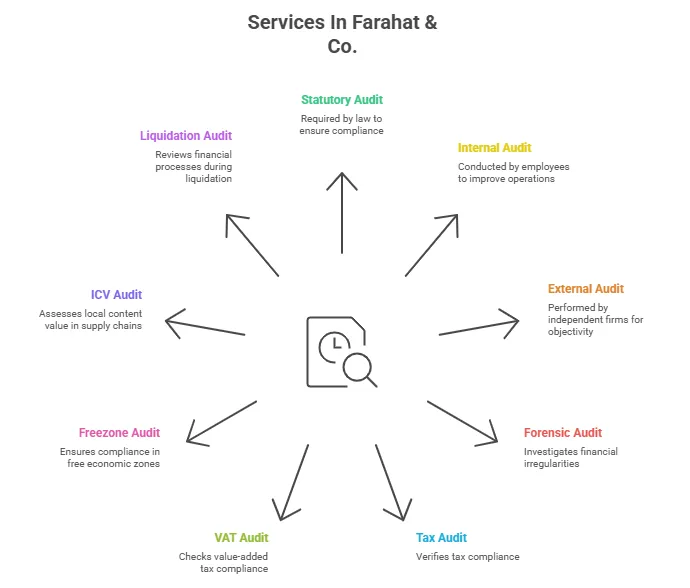

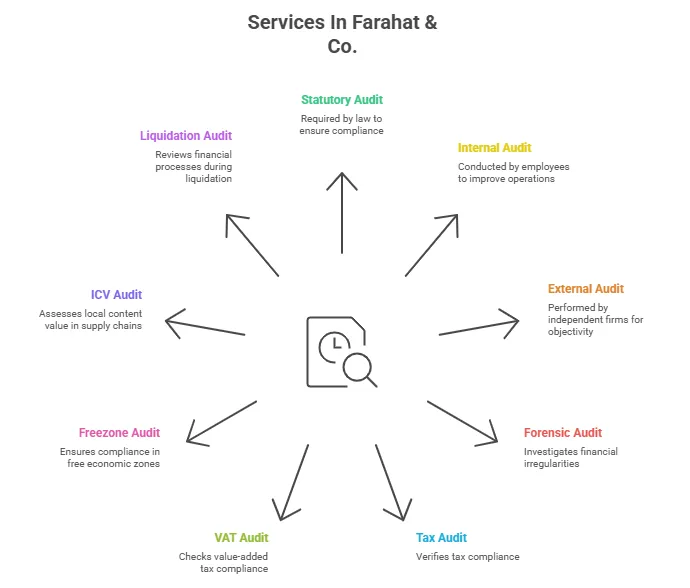

What Auditing services do Farahat & Co provide ?

The leading and reputable audit firm that provides a wide range of auditing services to meet the needs and expectations of our clients. Our auditing services include:

1. Statutory Audit

For some organizations, such as publicly listed companies, banks, insurance companies, and governments, a statutory audit is an audit that is required by law or regulation of the nation. A Statutory Audit must be conducted regularly by UAE public sector enterprises to verify compliance with government rules.

An appointed Statutory Auditing company in the UAE is required to audit the financial records of all government agencies.

2. Internal Audit

For your company to function smoothly, Farahat & Co. offers internal audit services in the UAE. These services identify inefficiencies at every stage of operation and propose strategies for risk reduction so that the organization may overcome obstacles and achieve its objectives.

Our internal auditing team can provide personalized solutions that will add strategic value to your company.

Our accounting company, which is among the top internal audit companies in the United Arab Emirates, provides innovative solutions to ensure that your corporate audits go perfectly.

3. External Audit

When an external auditing team is chosen either voluntarily by the company or by a third party—a creditor, client, regulator, or other—they carry out an external audit. To guarantee and validate the accuracy and validity of the information, data, or procedures used by the organization, an external audit is performed.

4. Forensic Audit

Examining and assessing a company’s or person’s financial or accounting records is called a forensic audit. An auditor looks for evidence conducting a forensic audit that may be presented in court. The purpose of a forensic audit is to find evidence of illegal activity like misappropriation or fraud.

5. Tax Audit

One of the Top audit firms in Dubai offers tax audit-related services in the UAE. A tax audit is simply a government’s examination of a firm regarding its responsibilities as a taxable entity. The FTA performs this kind of audit to make sure that all obligations are fulfilled and that all taxes are collected and sent to the government on schedule.

The government evaluates a company’s compliance with tax rules, such as VAT and excise taxes, to see whether it is fulfilling its obligations.

Farahat And Co

Top Audit Firm In Dubai since 40 years

Who Can Do an Audit in UAE ?

As per Article 15 of the Federal Decree Law No. (41) of 2023 Concerning the Regulation of the Accounting and Auditing Profession, it is stated as follows:

- Unless the SCA certification is secured, the Accounting Firm is not permitted to do audits or reviews of the financial accounts of public joint stock corporations or mutual funds.

- The Accounting Firm appointed by the banks, insurance companies, investment fund companies for the benefit of third parties, and public joint stock companies to audit and review their financial statements shall hold the professional license issued by the Ministry, subject to Clause (1) of this Article and any other conditions provided by the laws enforced in the State. The period of holding the license shall not be less than (5) five years.

- Any restrictions, requirements, or fees for the Accounting Firms’ certification must be approved by the SCA Board of Directors.

- SCA is required to notify the Ministry of the names of the certified accounting companies as well as any criminal fines or disciplinary actions that SCA has taken against them.

Further, as per Ministerial Resolution 111-2 of 2022, to obtain a license, accounting professionals need to clear compulsory exams on International Financial Reporting Standards (IFRS), International Standards on Auditing (ISAs), and UAE tax and regulations.

However, those who have credentials from any of the six professional bodies – ACCA, ICAEW, AICPA, CPA Australia, CPA Canada, and Saudi Organization for Chartered and Professional Accountants are exempt from the accounting and auditing standards examinations.

Conclusion

Since 1985, Farahat & Co has been in the business of delivering a wide array of services, such as auditing, accounting, tax consulting, and business liquidation, with a great understanding of the UAE corporate landscape. This level of expertise allows the firm to tailor its services to fit the unique needs of its clients.

The decision to choose the right audit firm is very important and will eventually affect the financial health of your business. What is essential is choosing a reliable and reputable firm that is also cost-effective to get value for your money.

Among the many roles of audit firms in Dubai, companies such as Farahat & Co play a leading role in identifying the errors, weaknesses, and strengths of your business. More importantly, they are supposed to come up with solutions to make your company get better at managing these issues and help move it forward.

Farahat And Co

Top Audit Firm In Dubai since 40 years

Frequently-asked questions

1. How often is the business supposed to conduct audit services?

- Most companies in UAE need an annual audit. However, an internal audit could be quarterly or yearly, depending on risk levels.

2. What is the purpose of an internal audit versus an external audit?

- An internal audit enhances the processes and controls within a company, and an external audit verifies the financial statements for the regulators and stakeholders.

3. How does auditing assist in tax filing?

- Audited accounts mean accuracy for VAT and corporate tax calculations, hence minimizing risks of penalties.

4. Why are audits necessary for the companies in Dubai?

- Because they instill trust, maintain legal compliances, and provide investor confidence.

5.What should I bear in mind when choosing auditors in Dubai?

- Their qualification, licensing, experience, fee structure, technology, and reputation.

6. On what basis are audit firms rated in Dubai?

- Based on compliance, use of technology, experience, ethics, client retention, industry specializations, and quality of service.

7. Why Farahat & Co.?

- We are fully licensed, experienced, and trusted across the UAE to deliver accurate, compliant, and timely audits.