Corporate Tax Services in UAE

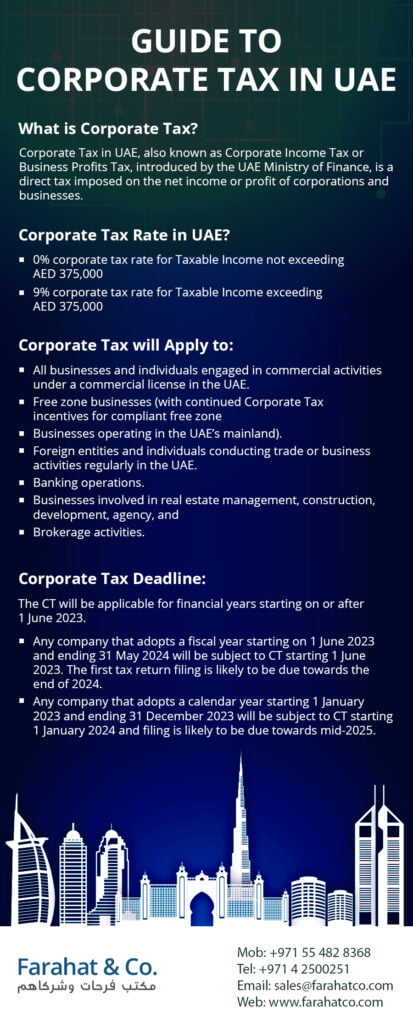

Corporate Tax in UAE, also known as Corporate Income Tax or Business Profits Tax, introduced by the UAE Ministry of Finance, is a direct tax imposed on corporations and businesses’ net income or profit. This tax reform is designed to support small and medium enterprises by instituting an initial statutory tax rate of 9% on corporate profits exceeding AED 375,000. Profits falling below this threshold will be zero-rated.

Compliance with corporate tax regulations is obligatory for all eligible Taxable Persons in the UAE. This involves initiating corporate readiness and registration, filing annual tax returns, and maintaining accurate accounting records by statutory laws and regulations.

Whereas, the introduction of Corporate Tax in the UAE is aligned with the nation’s strategic objectives to facilitate growth and transformation. Leveraging its extensive network of double tax treaties, the UAE aims to establish a competitive corporate tax framework that adheres to international standards.

This move solidifies the UAE’s position as a premier destination for business and investment. The UAE Corporate Tax Code draws from global best practices and encompasses widely accepted concepts, ensuring clarity and ease of comprehension.

What is the Corporate Tax Rate in the UAE?

The Corporate Tax rate in the UAE stands at 9% for Taxable Income exceeding AED 375,000, while Taxable Income below this threshold incurs a 0% rate of Corporate Tax.

Corporate Tax is applicable as follows:

| Taxable Person | Applicable Tax Rate |

|---|---|

| Natural persons and juridical persons | 9% on Taxable Income exceeding AED 375,000 |

| Qualifying Free Zone Persons | 0% on Qualifying Income9% on Non-Qualifying Income |

Applicability of Corporate Tax in the UAE

Corporate Tax applies to:

- All businesses and individuals engaged in commercial activities under a commercial license in the UAE.

- Free zone businesses (with continued Corporate Tax incentives for compliant free zone businesses operating in the UAE’s mainland).

- Foreign entities and individuals conducting trade or business activities regularly in the UAE.

- Banking operations.

- Businesses involved in real estate management, construction, development, agency, and brokerage activities.

Who is Subject to UAE Corporate Tax?

The following “Taxable Persons” shall be subject to Corporate Tax in the UAE:

- UAE corporations and other legal entities incorporated in the UAE or effectively managed and controlled there.

- Natural individuals engaged in business or commercial activities in the UAE.

- Non-resident legal entities with a permanent presence in the UAE (non-resident juridical persons).

- Legal entities established in a UAE Free Zone are also considered “Taxable Persons.”

What Constitutes a “Business” or “Business Activity” Under Corporate Tax?

Under the Corporate Tax Law in the UAE, the definitions of “Business” and “Business Activity” are pivotal in determining the tax liability of individuals and entities. These terms are instrumental in identifying those who qualify as Taxable Persons subject to UAE Corporate Tax.

The term “Business” encompasses any economic activity undertaken by an individual or entity, whether it is of a continuous or short-term nature. Crucially, it implies an intention to generate a profit and entails a structured and organized approach to the activity.

It’s essential to note that a Business or Business Activity, within the context of UAE Corporate Tax, doesn’t lose its identity based on its profitability.

Who Qualifies as a Resident Person for UAE Corporate Tax Purposes?

Under UAE Corporate Tax, Resident Persons encompass companies incorporated in the UAE, including Limited Liability Companies, Private Joint Stock Companies, Public Joint Stock Companies, and other juridical entities that operate within the UAE. These entities are automatically classified as “Resident” Persons for UAE Corporate Tax purposes due to their incorporation in the UAE.

Additionally, natural persons engaged in a Business or Business Activity within the UAE are also considered Resident Persons for UAE Corporate Tax purposes.

Moreover, foreign companies can attain the status of Resident Persons for UAE Corporate Tax if they are “effectively managed and controlled” from within the UAE. Determining the effective management and control of a company entails evaluating various factors, including the location where the company’s board of directors makes strategic decisions that significantly impact the company.

Who Is Considered a Non-Resident Person for UAE Corporate Tax Purposes?

By the Corporate Tax Law, a juridical entity is classified as a Non-Resident Person if it is incorporated in a foreign country and its effective management and control occur outside the UAE. Natural persons are designated as Non-Resident Persons for UAE Corporate Tax purposes if they do not engage in a taxable Business or Business Activity within the UAE.

How Are Non-Resident Persons Subject to UAE Corporate Tax?

Non-resident persons are only subject to UAE Corporate Tax under specific circumstances, which include:

- Income attributed to their Permanent Establishment in the UAE.

- Income attributable to a nexus in the UAE, as determined in Cabinet Decision No. 56 of 2023.

- Income derived from sources within the UAE is subject to a 0% Withholding Tax.

How is Taxable Income Determined for UAE Corporate Tax?

Taxable Income for a given Tax Period is calculated as the accounting net profit or loss of the Business, with adjustments made for specific items specified in the Corporate Tax Law and relevant implementing decisions.

The accounting net profit or loss corresponds to the amount reported in financial statements prepared by International Financial Reporting Standards (IFRS).

Adjustments to the accounting net profit or loss are required for various items, including:

- Unrealized gains and losses (subject to the realization of principal election).

- Exempt Income, such as qualifying dividends and capital gains.

- Gains or losses arising from transfers within a Qualifying Group.

- Gains or losses associated with qualifying business restructuring transactions.

- Non-deductible deductions for Corporate Tax purposes.

- Transactions involving Related Parties and Connected Persons.

- Transfer of Tax Losses within a group, contingent upon meeting relevant conditions.

- Incentives or tax reliefs.

What is a Tax Period Under Corporate Tax in the UAE?

Given that Corporate Tax is levied on an annual basis, it is crucial to establish the concept of the “Tax Period.” The Tax Period corresponds to the financial year utilized for preparing financial statements. Typically, this aligns with the Gregorian calendar year, running from January 1 to December 31.

However, businesses are permitted to adopt a different 12-month period for financial statement preparation, and in such cases, the Tax Period aligns with the chosen financial year.

Are Natural Persons Subject to UAE Corporate Tax?

Natural persons are subject to UAE Corporate Tax if they generate an annual Turnover exceeding AED 1 million from a ‘Business’ or ‘Business Activity’ within the UAE, as defined by the Corporate Tax Law and Cabinet Decision No. 49 of 2023.

Are UAE Holding Companies Subject to UAE Corporate Tax?

UAE holding companies are subject to UAE Corporate Tax. However, dividends received from domestic shareholdings are conditionally exempt, and dividends from foreign shareholdings and capital gains from both domestic and foreign shareholdings can be exempted if they meet the conditions of the Participation Exemption.

What Is a Juridical Person Under Corporate Tax?

A “juridical person” is an entity established or officially recognized under the laws and regulations of the UAE or foreign jurisdictions. Such entities possess a legal personality distinct from their founders, owners, and directors.

Examples of UAE domestic juridical entities include limited liability companies, foundations, onshore trusts, public or private joint stock companies, and other entities with separate legal personalities under applicable UAE mainland legislation or Free Zone regulations.

Branches of UAE or foreign juridical entities operating within the UAE are considered extensions of their “parent” or “head office” and are not treated as separate juridical persons.

Who Is Exempt From UAE Corporate Tax?

Certain entities and individuals are automatically exempt from UAE Corporate Tax, while others may apply for exemption.

The exemptions include:

| Automatically Exempted Persons | Exempted upon Application |

| The UAE Federal and Emirate Governments, along with their departments, authorities, and public institutions. | Qualifying Investment Funds meeting prescribed conditions. |

| Companies wholly owned and controlled by a Government Entity conducting a Mandated Activity. | Public or private pension or social security funds meeting conditions specified in Ministerial Decision No. 115 of 2023. |

| Businesses engaged in extracting UAE Natural Resources or related non-extractive activities are subject to Emirate-level taxation (subject to specific conditions). | UAE juridical entities wholly owned and controlled by certain exempted entities, engaging in activities specified in Article 4(h) of the Corporate Tax Law. |

| Qualifying Public Benefit Entities listed in Cabinet Decision No. 37 of 2023 or subsequent relevant decisions. |

Will Small Businesses Receive UAE Corporate Tax Relief?

Small businesses with revenues of AED 3 million or below for the relevant Tax Period and preceding Tax Periods have the option to elect “Small Business Relief” for Tax Periods ending on or before December 31, 2026.

Choosing Small Business Relief means that a Taxable Person is treated as having no Taxable Income for the respective Tax Period and can enjoy simplified compliance obligations.

To claim Small Business Relief, an election must be made in the Taxable Person’s Corporate Tax Return for the relevant Tax Period.

What is “Small Business Relief” Under Corporate Tax in the UAE?

Small Business Relief provides relief to certain businesses by exempting them from calculating and paying Corporate Tax and from complying with the regular Corporate Tax reporting requirements. To be eligible, a Taxable Person must have revenue of AED 3 million or below for the relevant Tax Period ending on or before December 31, 2026, as well as prior Tax Periods.

If a Taxable Person’s revenue exceeds AED 3 million in any Tax Period, they are no longer eligible for Small Business Relief for that period and subsequent periods.

Who Qualifies as a Multinational Enterprise Group?

Multinational Enterprise Groups are groups of companies operating in multiple countries with a consolidated group revenue exceeding AED 3.15 billion. Members of such groups cannot apply for Small Business Relief.

Who is a Free Zone Person?

A Free Zone Person is a legal entity incorporated or established under the regulations of a Free Zone, or a branch of a mainland UAE or foreign legal entity registered in a Free Zone.

A foreign company relocating its place of incorporation to a UAE Free Zone also qualifies as a Free Zone Person.

The Free Zone Corporate Tax regime exclusively applies to Free Zone Persons and determines which income can benefit from the regime by treating income from transactions with other Free Zone Persons as Qualifying Income.

Who is a Qualifying Free Zone Person?

A Qualifying Free Zone Person is a Free Zone Person who meets all the conditions of the Free Zone Corporate Tax regime, allowing them to benefit from it. These conditions include maintaining sufficient substance within a Free Zone, deriving Qualifying Income, refraining from electing the regular UAE Corporate Tax regime, adhering to arm’s length pricing principles, maintaining audited financial statements, and more.

Failing to meet these conditions results in a Qualifying Free Zone Person losing its qualifying status for five Tax Periods.

How Are Qualifying Free Zone Persons Taxed Under the UAE Corporate Tax Regime?

Qualifying Free Zone Persons are subject to a 0% Corporate Tax rate on their taxable income generated from Qualifying Activities and transactions with other Free Zone Persons unless the income derives from Excluded Activities.

When a Qualifying Free Zone Person operates outside a Free Zone through a Permanent Establishment in mainland UAE or a foreign country, the profits attributed to that Permanent Establishment are subject to the UAE Corporate Tax rate of 9%.

To avoid double taxation of foreign Permanent Establishment profits, the UAE offers relief through its extensive double tax treaty network and the provisions of the UAE Corporate Tax Law. Certain income from Immovable Property in a Free Zone is also subject to the 9% Corporate Tax rate.

Can a Foreign Company Benefit From the Free Zone Corporate Tax Regime?

A foreign company can register a branch in a Free Zone and take advantage of the Free Zone Corporate Tax regime for Qualifying Income attributable to that Free Zone branch.

Ownership restrictions or requirements do not prevent a Free Zone company from benefiting from the Free Zone Corporate Tax regime, even if it is wholly or partially owned by a foreign entity.

Are Family Foundations subject to UAE Corporate Tax?

Family Foundations and certain trusts are independent juridical entities with separate legal personalities. They are typically subject to UAE Corporate Tax.

However, some types of Family Foundations can opt to be treated as transparent “Unincorporated Partnerships” for UAE Corporate Tax purposes.

This treatment allows the founder/settlor and the beneficiaries to be considered owners of the foundation’s assets, generally exempting the foundation’s income from UAE Corporate Tax.

Other types of trusts, such as those established in DIFC or ADGM, do not possess separate legal personalities and are treated as transparent vehicles for UAE Corporate Tax purposes.

Are Investment Funds Subject to UAE Corporate Tax?

Investment funds are often structured as limited partnerships or other unincorporated vehicles to maintain tax neutrality for investors. This structure aligns with most countries treating limited partnerships as transparent entities for tax purposes, which ensures that investors are taxed as if they had invested directly in the fund’s underlying assets.

Investment funds structured as partnerships, unit trusts, or unincorporated vehicles are generally treated as fiscally transparent “Unincorporated Partnerships” for UAE Corporate Tax purposes.

However, investment funds structured as corporate entities, including Real Estate Investment Trusts (REITs), or partnership funds that choose to be treated as a “Taxable Person” for UAE Corporate Tax purposes, can apply for exemption from UAE Corporate Tax if they meet specific requirements.

What Standards Must Be Used for Preparing Financial Statements?

For UAE Corporate Tax purposes, financial statements of UAE entities and other businesses must adhere to International Financial Reporting Standards (IFRS). If a business’s revenue does not exceed AED 50,000,000, the use of IFRS for SMEs is acceptable.

For entities with revenue not exceeding AED 3,000,000, the Cash Basis of Accounting is an acceptable alternative.

What Expenses Are Deductible for Calculating Taxable Income?

In general, business expenses incurred to generate Taxable Income are deductible, subject to certain exceptions and restrictions outlined in the Corporate Tax Law. The timing of these deductions may vary based on the nature of the expenses and the accounting method used.

Expenditures related to capital assets are typically recognized through depreciation or amortization deductions over the economic life of the asset.

Expenses with dual purposes, such as those incurred for both personal and business reasons, need to be apportioned, with only the relevant portion deductible as incurred “wholly and exclusively” for the Taxable Person’s business.

What Are Transfer Pricing Rules?

Transfer pricing rules are designed to ensure that transactions between Related Parties are conducted at arm’s length as if they were carried out between independent entities. These rules aim to prevent the manipulation of Taxable Income.

Can Prior-Year Tax Losses Reduce Taxable Income in the UAE Corporate Tax Regime?

Tax Losses can offset Taxable Income in future periods under specific conditions. Taxable Persons can offset Tax Losses against Taxable Income in subsequent periods, up to a maximum of 75% of the Taxable Income in each of those future periods.

Any unused Tax Losses can be carried forward indefinitely to offset against Taxable Income in future Tax Periods.

For example, if a Taxable Person has a Taxable Income of AED 100,000 and carries forward losses of AED 125,000, they can offset AED 75,000 of losses in the relevant Tax Period, reducing Taxable Income to AED 25,000. Unused losses decrease to AED 50,000 (AED 125,000 – AED 75,000).

Seek Expert Corporate Tax Services in the UAE

Engaging professional Corporate Tax Consultants is crucial to ensure compliance and navigate the complexities of taxation. Expert consultants can assist with tax planning, structuring, compliance, and more, ensuring that individuals and organizations meet their tax obligations while benefiting from applicable exemptions and legal strategies.

At Farahat & Co, our team of experienced corporate tax experts possesses a profound understanding of the intricate financial landscape in the UAE and upholds unwavering principles of integrity. Contact us today, and we shall be glad to assist you.

Frequently Asked Questions

What is Federal Corporate Tax in UAE?

Corporate Tax, also known as Corporate Income Tax or Business Profits Tax, is a direct tax imposed on the net income or profit of corporations and businesses.

Corporate Tax in UAE Applies to Which Persons?

UAE Corporate Tax applies to legal entities incorporated in the UAE, foreign entities effectively managed and controlled in the UAE, and foreign entities operating through a Permanent Establishment or having a taxable presence in the UAE.

Are Natural Persons Subject to UAE Corporate Tax?

What Are the Corporate Tax Rates in UAE?

The UAE Corporate Tax rates are as follows:

| Taxable Person | Applicable Rate |

| Natural persons and juridical persons | 9% for Taxable Income exceeding AED 375,000. |

| Qualifying Free Zone Persons | 0% on Qualifying Income and 9% on non-Qualifying Income |

Who Are Exempted Persons Under UAE Corporate Tax?

Exemptions from UAE Corporate Tax include UAE Federal and Emirate Governments, certain government-owned companies, businesses involved in UAE Natural Resources extraction or related activities, and Qualifying Public Benefit Entities.

Who Can Apply for Exemption Under Corporate Tax in UAE?

Certain entities can apply for exemption upon approval, such as Qualifying Investment Funds, pension or social security funds, and UAE juridical persons wholly owned by exempted entities engaged in specified activities.

Who Can Get Small Businesses Relief Under UAE Corporate Tax?

Who Should Register for Corporate Tax in UAE?

All Taxable Persons, including Free Zone Persons, must register for Corporate Tax and obtain a Corporate Tax Registration Number.

What Are the Required Documents for Corporate Tax Registration?

Documents required for Corporate Tax registration in the UAE include proof of address, company details, and audited financial statements showing the accounting period used for financial reporting, with any changes disclosed to the tax authority before filing tax returns.

Code Embed: Cannot use CODEJS as a global code as it is being used to store 7 unique pieces of code in 8 posts