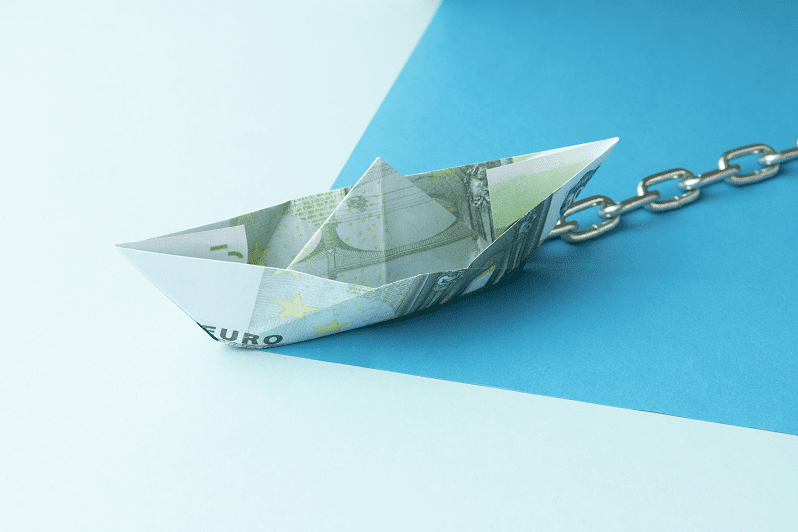

The Securities and Commodities Authority (SCA) has taken stringent actions against many companies for breaking regulations and for non-compliance with money laundering and terrorism financing rules. Recently, the SCA imposed a penalty of Dh1.15 million on companies that defaulted on these regulations. The strong stance underlines the commitment of the country against financial crimes, which therefore emphasizes more on transparency within the business environment.

UAE’s AML and CTF Regulations: An Overview

Due to serious efforts undertaken by the government in the UAE to curb the menace of money laundering and financed terrorism, the laws require that businesses carry out due diligence in maintaining transaction records and reporting suspicious activities. The major laws include:

- Federal Decree-Law No.20 of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism.

- Cabinet Decision No. 10 of 2019 on the Implementation of AML and CTF Regulations.

These laws are implemented and enforced by the ministries of economy, UAE Central Bank, and the Financial Intelligence Unit (FIU). Entities that are found guilty of any form of regulatory non-compliance attract severe punitive measures such as severe financial penalties, restrictions on business, or even license suspension.

Companies Penalized for AML and CTF Violations in the UAE

The UAE government actively supervises companies and enforces penalties in cases of violations against anti-money laundering laws. Some of its pivotal actions include:

Dh1.15 Million in Fines for violating AML laws

Recently, the Securities and Commodities Authority fined companies found guilty of violating anti-money laundering and counter-terrorism financing laws Dh1.15 million. Some of the violations are failing to report suspicious transactions, having poor due diligence and poor record keeping practices.

Category of Fines Instituted by SCA

Since January 2025, the SCA has imposed fines amounting to AED 1.15 million, including:

- AED 650,000 from companies and investors for violating market rules.

- AED 500,000 to other companies for not complying with the AML/CFT provisions and engaging in activities that are not within the scope of their license.

SCA’s Commitment to Market Integrity

The SCA is still implementing very strict measures and giving very clear regulatory guidance in order to increase the level of investor protection and thus to enhance the position of the UAE as one of the world’s leading financial centers.

Consequences of AML Non-Compliance in the UAE

Business establishments may face serious consequences for failure to comply with AML and CTF laws:

- Heavy Fines: Penalties for violators may go from thousands to millions of Dirhams, depending on the severity of a violation.

- Business Constraints: Restrictions could be imposed upon the ability of companies to carry out their business-licensed activities regarding hundreds of transactions and banking-related services.

- Suspension or Cancellation of License: Violations or breaches of the law if repeated or are severe may lead to the cancellation of business licenses.

- Criminal Convictions: Imprisonment, travel restrictions, and asset freezing may be applied against people involved in money laundering or financing acts of terrorism.

How to Ensure AML Compliance in the UAE

Businesses in the UAE can follow certain steps that should be taken in order to comply with the local AML and CTF laws and avoid penalties:

Formulate a Strong AML Policy

Companies must develop and enforce robust internal AML policies containing:

- Risk assessment

- Customer due diligence (CDD) and, where necessary, enhanced due diligence (EDD)

- Reporting procedures for suspicious transactions

Training of Employees in Relation to AML Compliance

Regular training helps employees to understand their tasks, including the identification of suspicious activities, as well as their own roles and responsibilities to report.

Keep Accurate Records

Records relating to financial transactions are required to be kept by a company for a minimum of five years. This is helpful in auditing or investigations by regulatory authorities.

Employ AML Compliance Software

Sophisticated AML compliance software can spot suspicious activities and facilitate reporting through process automation and compliance enhancement. Most companies in the UAE use AI-powered solutions for compliance in order to mitigate the exposure to risks.

Keep on Executing AML Audits

Put yourself on the regular mapping of audits to make sure that there is compliance with UAE law. The external auditing would be done by financial experts in order to establish loopholes within compliance and make recommendations for improvements.

Report Suspicious Activities

Any suspicious financial transaction should be reported by the companies to the FIU in the UAE by the official portal “goAML”.

Future of AML Regulations in the UAE

The UAE continues to strengthen its AML and CTF laws to meet international standards. The UAE is collaborating with global financial institutions and organizations to enhance regulatory frameworks and ensure transparency in the financial system along with the Financial Action Task Force (FATF).

Increased enforcement actions and stricter penalties compel businesses to keep updated with compliance requirements and take necessary proactive measures to prevent financial crimes.

How Farahat & Co. Can Help with AML Compliance in the UAE

We have the AML experts to assist you with:

- Risk assessment and compliance audit of AML

- Assistance in the implementation of AML policy

- Training of employees on AML regulations

- Advisory on suspicious transaction reporting

- Advice on AML software selection and implementation

With Farahat & Co.’s help, ensure that your business stays compliant and avoids penalties. For expert AML compliance assistance in the UAE, get in touch with us today.