The audit has been known to be a helpful component in a company’s financial status. The opinions or findings of an auditor help management to change their strategy or handle certain matters more efficiently.

The audit also gives awareness to management about their financial status. There are times when companies are unaware of what their financial status is, making them oblivious that they have been spending more than they should.

With an auditor assessing your financial statements and internal controls, you will have the assurance that you have a fair and correct representation of your company’s financial status on those papers. You can be assured that your firm is economically healthy.

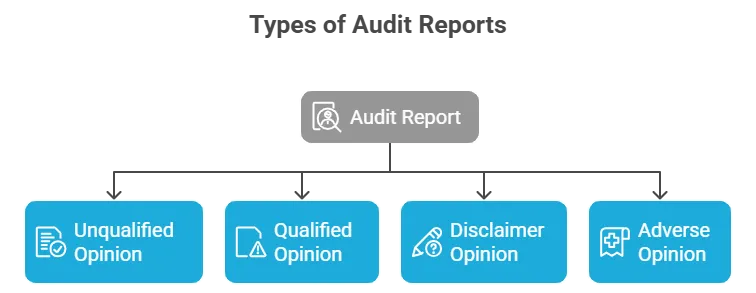

What Are the 4 Types of Audit Reports?

The 4 types of financial inspection reports are Unqualified Opinion, Qualified Opinion, Disclaimer Opinion, and Adverse Opinion.

1. Unqualified Opinion

This is the report that states that the financial statements of a company are fairly presented and follow the accounting standards.

2. Qualified Opinion

This is a kind of report that expresses that it cannot state an unqualified opinion because of several reasons. A reason can be that the financial statements do not follow the accounting standards.

3. Disclaimer Opinion

This is a kind of report that auditors present when they cannot give a distinct opinion on the financial inspection because they didn’t have the opportunity to fulfill certain tasks because of a lack of information or assistance from the side of the management, improperly maintained financial records, etc.

4. Adverse Opinion

This kind of report from an auditor is alarming because it means that there has been a gross misstatement in the financial statements of a company and even possibly fraud.

Your Business Solution

Dubai’s Expert Advice at Your Fingertips

A Quick Overview of an Audit(inspection) Report

An external auditor always has an financial inspection report to present to the management of a company that they have audited. It contains their findings and their opinions about the financial statements and internal controls of a company. An audit report has the valuable information that a company needs.

What is the Auditor’s Opinion in the Audit Report ?

One of the most critical parts of the independent auditor’s report is the Auditor’s Opinion. This section states whether the company’s financial statements give a true and fair view (or present fairly, in all material respects) in accordance with the applicable framework.

Based on the opinions, the auditor explains how they conducted the audit. It typically refers to generally accepted auditing standards (GAAS) or International Standards on Auditing. They also provide information about independence and following the proper process.

The evidence for the audit is mainly gathered by inspecting records, interviews, or testing internal controls. The report also includes Key Audit Matters for the listed entities. This particular area requires significant auditor judgment. These are disclosed per ISA 701 (or similar), and they help stakeholders understand what in the audit presented the greatest risk or complexity.

Additional sections often include:

- Responsibility of management, which includes the duty to prepare financial statements, design internal controls, etc

- Auditor’s responsibilities in assessing risk, obtaining inspection evidence, and forming an opinion

- A proper comment on non-financial information that helps the financial statement.

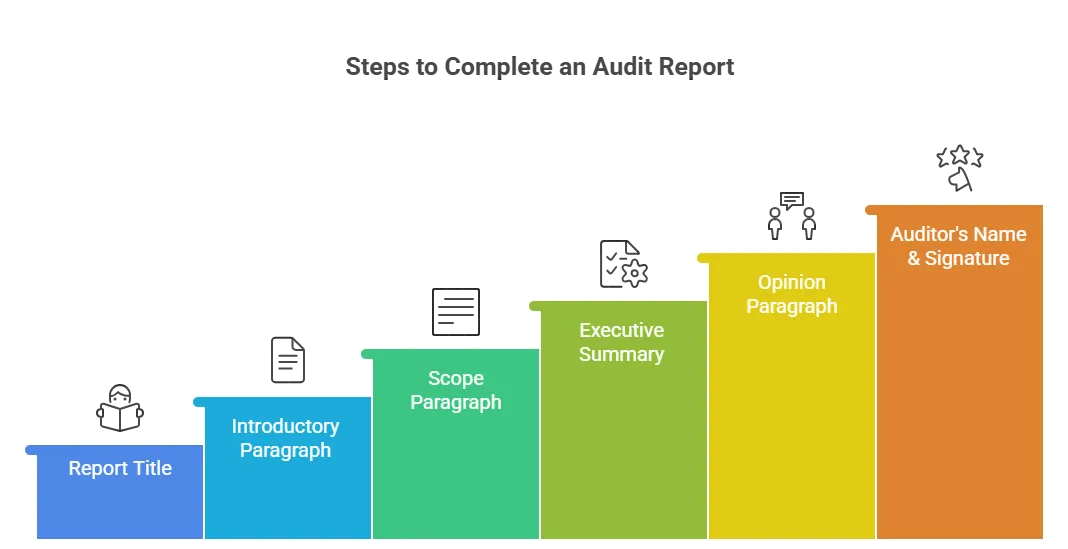

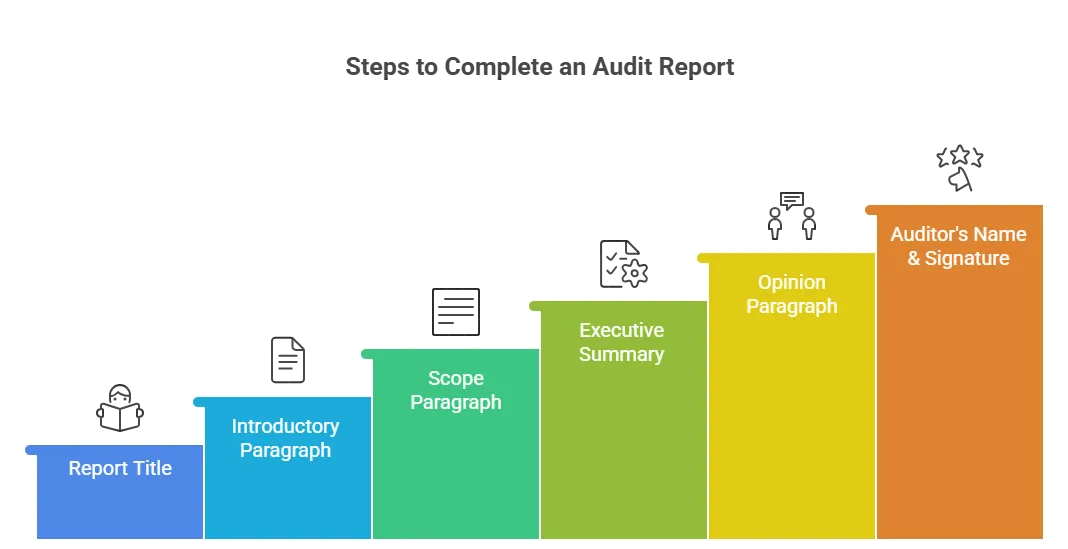

7 Elements of Audit Report

The inspection report template includes 7 parts elements these are: report title, introductory Paragraph, scope paragraph, executive summary, opinion paragraph, auditor‘s name, and auditor’s signature.

1. Report Title

This has the basic components of an financial inspection report: the date (which is usually the last day of when an inspection is held) and the addressee (which is the stockholders or board of directors of the audited company).

2. Introductory Paragraph

This part is where it is stated that an financial inspection is carried out in the company stated above. It also stated here the financial records that were used in the inspection that was conducted. This is also where it is stated that it is a company’s responsibility to ensure that its financial statements are correct and fair by the internationally accepted accounting standards.

3. Scope Paragraph

This is a paragraph that expresses that the rules and methods that were followed by an auditor in the inspection were set by the Generally Accepted financial inspection Standards. These were fundamentally for the intention of presenting companies with a reasonable assurance that whatever is shown in their financial statements is correct.

4. Executive Summary

This segment discusses the findings of an auditor. An auditor writes here the matters that are important in their view for the management of a company to know. This is merely the summary of what has been found by an auditor, not their opinion about their findings. This is simply comprised of what they have assessed in their timeframe in auditing.

5. Opinion Paragraph

This is where an auditor’s opinion is stated, whether they believe that a company’s financial statements are correct and fair and follow the accounting standards or not. They also state the methods used in how they have arrived at such a conclusion.

6. Auditor’s Name

An auditor’s name is then identified after all the information above, ensuring that it is clear that the author of the inspection report is the auditor who conducted the inspection himself. If an auditor works in a third-party organization, the name of their firm needs to be included as well.

7. Auditor’s Signature

An auditor’s signature signifies that an auditor who writes an audit report acknowledges the responsibility that they are held accountable for about the results of the inspection they have conducted.

Your Business Solution

Dubai’s Expert Advice at Your Fingertips

What are the Audit Report Format, Preparation, and Best Practices ?

An effective inspection report requires a better format, planning, and compliance with the standards and regulations.

Audit Planning & Scope

- Define the objectives, scope, and materiality thresholds of the audit clearly

- Use the inspection checklist, which works well with IFRS and GAAP

- Prepare an inspection schedule that manages tasks across the team

Standards & Regulations

- Follow the international standards like ISA, GAAS, or ISO 9001

- Work together with the UAE regulatory requirements, like the UAE Commercial Companies Law, to check annual audits

- It is important to work with standards like HIPAA for data protection and the healthcare sector.

Evidence Gathering

- Review documentation — invoices, receipts, meeting minutes, policies, and procedures.

- Check the documentation, like invoices, receipts, meeting minutes, policies, and procedures.

- Check the internal controls, like segregation of duties, authorization protocols, and management oversight

- Interview employees, perform testing, and validate records.

Use of Technology

- Implement inspection software or data analytics tools to improve efficiency and depth.

- Maintain clear documentation of findings and decisions.

Report Drafting

- Always use a clear structure like title, addressee, opinion, basis of opinion, etc

- Don’t forget to include key inspection matters where useful

- Make sure the management review and oversight are done before finalising.

Stakeholder Communication

- Present the report to stakeholders (board, audit committee).

- Present the report to stakeholders, like the board and the audit committee

- Provide a proper recommendation to reduce risk and control improvements

- Follow up on corrective actions to be done after the audit.

What is the Purpose and Importance of Audit Reports

The audit report is a proper evaluation of the financial statements of the company. It is an independent research that provides credibility, transparency, and reliability for others. It is important because:

- inspection report offers a formal statement from an external auditor. This assures that the statements are free from material misstatement and follow frameworks like GAAP or IFRS.

- It provides trust amongst investors, creditors, lenders, and other stakeholders.

- An inspection report can be useful for decision-making in the future.

- It helps in the evaluation of risk, highlighting internal controls, governance, or financial reporting

- Audit reports are important for compliance with financial regulations and corporate governance frameworks of the UAE.

- Proper inspection reports work well to improve accountability

- The standards of management will improve with better inspection reports. It supports better corporate governance.

What are the 5 C’s of Audit Reporting

The 5C in audit reporting refers to important aspects in the inspection report. It helps you to find the issue and also communicate findings in a better manner. These 5 c’s include:

- Condition: This talks about the situation that is being reviewed

- Criteria: What is the standard of benchmark being used?

- Cause: This talks about the reason why the issue came out

- Consequence: This focuses on the final impact of the issue

- Corrective Action: What are the steps that can be taken to solve the issue?

Your Business Solution

Dubai’s Expert Advice at Your Fingertips

What is the Difference Between Unqualified and Qualified Audit Report ?

Here’s a comparison table summarizing the differences between an unqualified (clean) audit report and a qualified audit report:

| Aspect | Unqualified Audit Report | Qualified Audit Report |

|---|---|---|

| Auditor’s Opinion | Positive / clean — financial statements present a true and fair view | Modified — “except for” specific issues |

| Material Misstatements | None identified | Material misstatements are identified, but are not pervasive |

| Scope Limitation | No limitation; full inspection performed | Possible limitation on the scope in certain areas |

| Reliability | High; stakeholders can trust the financial statements | Lower in the qualified area; requires further inquiry |

| Financial Reporting Framework | Fully complies with GAAP, IFRS, or applicable standards | Some exceptions to full compliance |

| Impact on Stakeholders | Strong confidence for investors, lenders, and management | Raises questions, especially in the qualified part; may affect decision-making |

| Materiality | No significant issues affecting materiality | The misstatements or limitations are material enough to matter, but not pervasive |

| Regulatory View | Best-case scenario | Acceptable, but indicates issues that need attention |

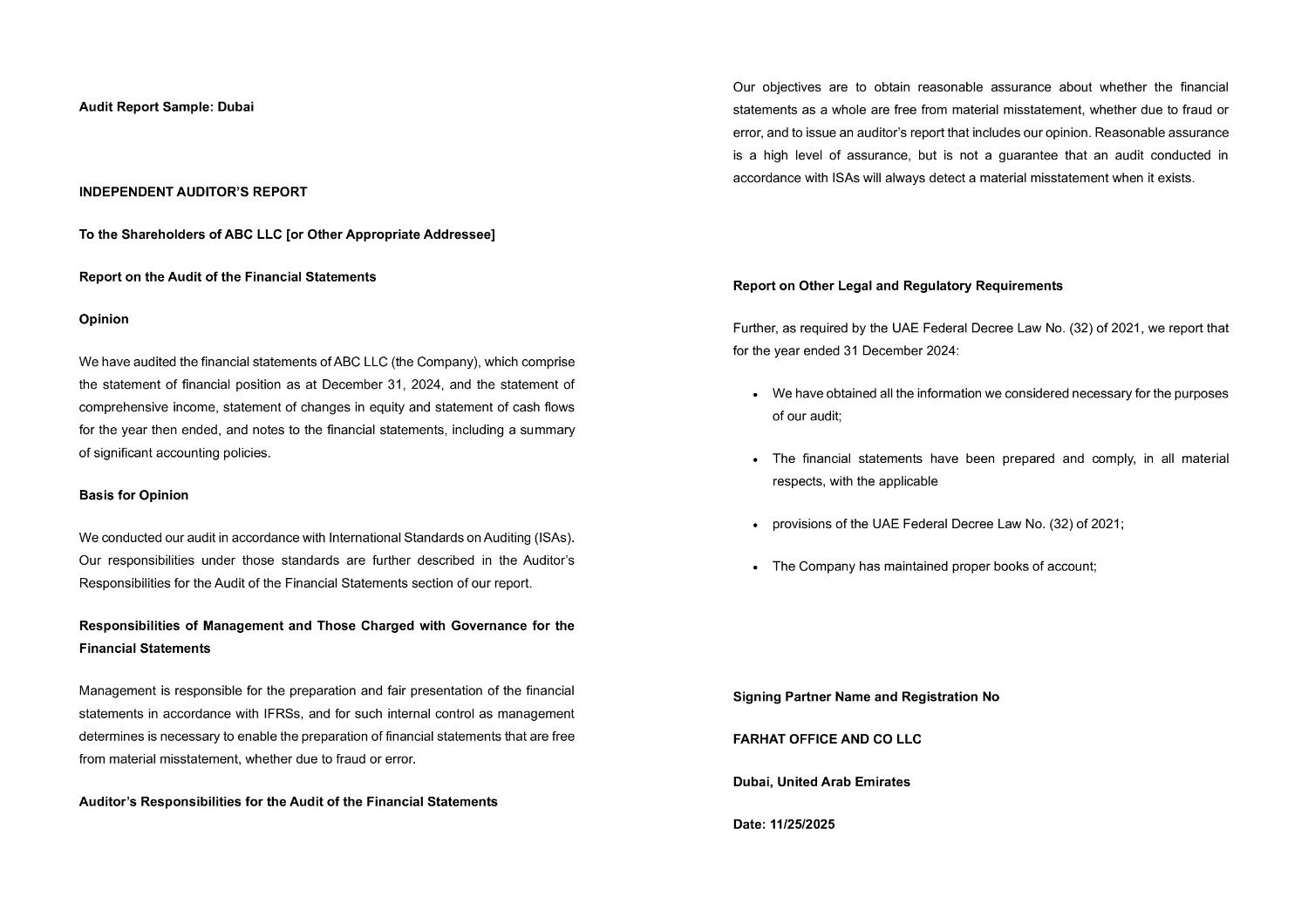

Real-World Audit Report Examples

- Listed Company Audit Report (with KAMs):

Many companies that are publicly listed issue auditor reports that include Key inspection Matters. It includes revenue recognition, impairment of assets, or concern assumptions. For example, under ISA 701, auditors highlight KAMs to communicate areas of significant risk. - UAE Company Audit Report:

In the context of the UAE, the auditors must follow the International Standards on Auditing while reporting.

- The inspection report is generally part of regulatory submissions for freezone companies. It should be prepared by a licensed auditor.

- The auditor must be independent, and the reports must meet formal structure and content requirements according to Annual Accounts Guidance.

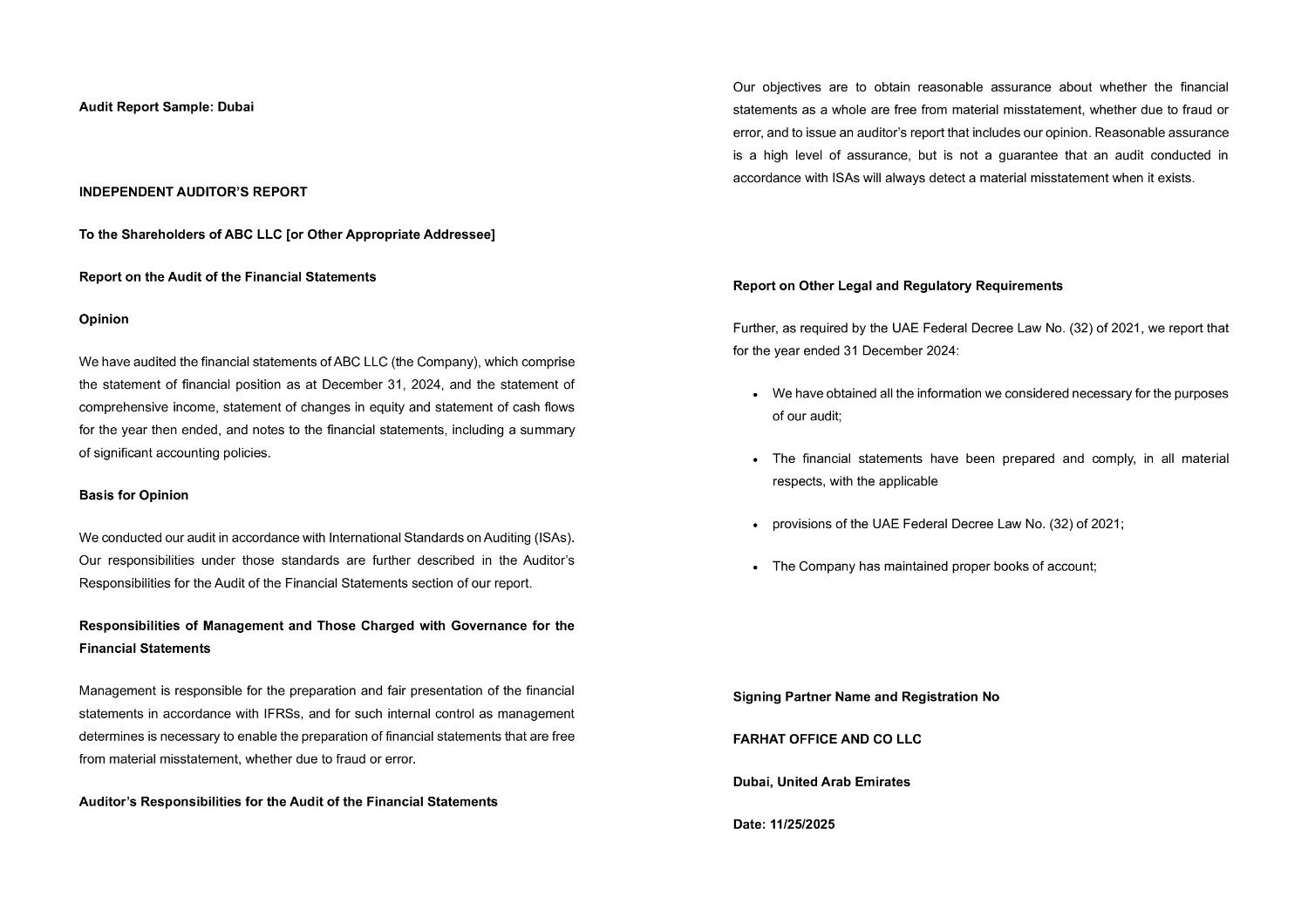

Sample of audit report

You can download the sample format from below.

Audit Report word/pdf sample:-Download Now

Expert Audit Consulting in Dubai – Get Professional Guidance with Farahat & Co.

There are a lot of things to know about inspection aside from its benefits. For you to understand more about the laws and what there is to know about the inspection , you need a consultant with experience in this field.

Farahat & Co. has a team of audit firms in Dubai and experienced consultants to surround you with information that you need to obtain.

You can discuss with one of our auditors in Dubai your needs or queries about audits whenever you need them. You can contact us and book a free consultation. We will ensure to have a team of knowledgeable individuals to assist you.

Your Business Solution

Dubai’s Expert Advice at Your Fingertips

FAQ

1. Can ACCA sign audit reports in the UAE?

- Yes, provided the ACCA-qualified professional is employed by or is a partner in a licensed audit firm in the UAE.

2. How to do an audit report?

There are certain steps to follow for an audit report. They are:

- Plan the inspection

- Gather evidence

- Perform a test of the evidence

- Evaluate the controls

- Draft the report with an opinion

- Review the report by senior auditors and management

3. What is an accounting audit report?

- It’s a formal independent auditor’s report expressing an opinion on a company’s financial statements.

4. What is ‘qualification’ in an audit report?

- When an auditor finds material misstatements or scope limitations, but they aren’t persuasive, the opinion is modified for certain items. This is referred to as a qualification in an audit report.

5. Who can sign an audit report in the UAE?

- An audit report can be signed by a licensed auditor or a partner in a licensed audit firm. The firm should be recognised by the UAE authorities or the Ministry of Economy.

6. What is the Importance of an audit report?

- Provides assurance, builds trust, helps with regulatory compliance, and supports investor confidence.

7. Can a CMA (Chartered Management Accountant) sign audit reports in Dubai?

- CMA alone generally does not suffice; the auditor must usually be part of a licensed audit firm and meet regulatory requirements.

8. How to conduct an audit report?

- An audit report is conducted through audit planning, evidence collection, testing, evaluation, reporting, and stakeholder communication.

9. Who needs an audit report?

- The audit report is required for shareholders, the board of directors, investors, lenders, regulators, etc. It is also required for anyone with a stake in the company.

10. What is the meaning of an audit report?

- An audit report is a formal written statement issued by the auditor. This report shows that the business is fair and accurate about the company’s financial statements.

11. What is an adverse audit report?

- An adverse audit report means that the material statements in the financial statements are incorrect and don’t present a true and fair view.

12. Why Audit Reports Matter?

- An audit report is important as it provides independent assurance, strengthens corporate governance, and improves the financial ecosystem

13. When do auditors prepare their reports?

- The auditors prepare their report after gathering sufficient evidence and finalising their findings. It is done at the end of their audit fieldwork.

14. Why does an auditor issue a disclaimer of opinion?

- An auditor issues a disclaimer of opinion when they can’t obtain enough audit evidence due to scope limitations.

15. Are audit reports required for all companies?

- Yes, most of the companies in the UAE must have audited financial statements based on their legal structure, location, and regulatory rules.

16. Who prepares an audit report, and who reads it?

- A licensed external auditor prepares it; it’s read by management, board of directors, shareholders, regulators, and creditors.

Conclusion

The Independent Auditor’s report is an important part of financial assistance. This particular report helps to fulfill legal and regulatory obligations in Dubai and the UAE. Similarly, it also works in strengthening the credibility among investors and stakeholders.

It is critical to understand the structure of an auditor’s opinion on key audit matters, the 5 C’s of reporting, and the difference between unqualified and qualified opinions. This helps the management and board members to make better decisions, improve internal controls, and maintain trust.

As the audit reports are right, it will help for stronger the governance and financial integrity of the firm. Ultimately, it will help in the development of the company.