If you have been living in the Middle East, you have quite often seen signages that say “lease”. What does it imply? And how do audit firms in UAE account under the IFRS 16? In a financial audit, leases accounting plays a very important role. In December 1997, the IASC adopted the standard of recording leases as a financing activity. The International Accounting Standards later adopted it in April 2001. Under the IFRS 16, however, lease accounting was further modified where the principles of recognition of the asset, the measurement of the value of the asset, its presentation on the financials and reporting of disclosures of the assets formed the basis of a financial report. Hence, it was essential for any accounting and financial services to learn the new way of calculation.

What is a lease liability?

This liability is a financial obligation to make payments as required by the contract, and it is discounted at the present value. The liability term is measured from the commencement day of the contract. This liability is part of the Right of Use of assets recorded in the financials, replacing the initial classification of “operating.”

To understand the lease presentation on a balance sheet, we must know the few concepts that form the component of the lease liability.

- Lease Term– To calculate this liability, the lease term must be over in 12 months. Accounting modifications are taken into consideration when the term is renewed or the contract is terminated.

- Lease payments- Payments made towards the asset for its upkeep, renewal or any initial direct cost. Also, payments such as incentives received from the assets are reduced from the total value while computing the liability.

- Discount rate– The discount rate adoption varies across the reporting standard such as the IFRS 16, ASC 482 or GASB 87. But the underlying concept of the report for all is the same. That is, to calculate the discount rate, an implicit interest rate is used.

For Example:

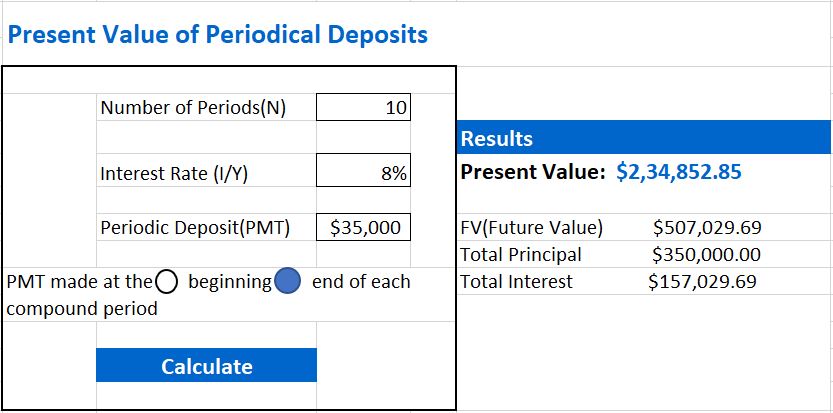

A company has a 10-year contract, with a payment of $35,000 each year; the Incremental Borrowing rate is 8%.

The lease liability calculates as the present value of payments for the contract term of the future cash flow or the sum of the money at a given rate of return. Simply put, it is the value of the money at present for the period of future expected cash flow or return. While calculating the lease liability present value plays an important role under the time value of the money concept.

Below is the simple calculation of the Lease Liability. Where the Liability is $234,852

Lease liability is further used to calculate the Right of Use asset. Suppose there is an initial direct cost for the asset of $5000 for the asset. Then the RoU will be calculated as $234,852.85+ $5000= $239,852.85. The Right to Use asset is debited, whereas the liability and Cash Account is credited. Click here to read more about audit services in Dubai.

What are the exemptions in lease liability accounting?

The IFRS Stand has two exemptions under which there are recognition and measurement exemptions.

Short Term Lease – This is defined as a term that is 12 or less than 12 months. The lessee has to have control over the terms of the contract period whether or not it will be extended or terminated to the extent that a short term lease will be converted to a long term one in the near future for considering it as an RoU component. A lease, however that includes a purchase option, is not a short term.

Low-Value Leases- Leases that are lower than a threshold value of $5000 as usually considered as

Summary

As per the IFRS 16, the main objective is to report and present information that faithfully represents all the lease transactions of a company and its implications on the valuation of cash flow, financial ratios arising due to the leasing activity. Hence, it is essential to recognize the asset and the liabilities transactions that occur from a lease. A lessee is required to identify the Right of Use asset under the IFRS 16. If the this value is for more than 12 months only, they are obligated to make payments arising from operating the contract. Farahat and Co are one of the leading accounting and financial services providers in the UAE. They include a great team of Chartered Accountants who have extensive experience in performing internal audits and external audits for companies across the UAE. If you’re looking for an audit firm, click here to book a consultation with Farahat and Co today!