Understanding AML

What is Anti-Money Laundering?

Anti-Money Laundering simply refers to the sets of rules and procedures formulated to prevent criminals from successfully converting illegal funds into legitimate assets. The aim is quite simple: prevent the money coming from fraud, corruption, or trafficking, among other crimes, from entering the financial system.

Money laundering usually occurs in three stages:

- Placement – the act of depositing illegal cash into the system, through deposits, property payments, or cash purchases.

- Layering: building complex transactions to disguise the source through transfers, multiple accounts, and offshore entities.

- Integration: This occurs when the money is “cleaned”, then used to purchase assets, which may include real estate, businesses, or luxury items.

Real estate firms, banks, and brokers are obliged to adhere to such AML requirements as:

- Know Your Customer (KYC)

- Customer Due Diligence (CDD)

- Risk assessment

- Transaction monitoring

- Reporting suspicious activity

Since property dealings involve huge amounts, extra care must be given by real estate firms.

Understanding AML in the UAE Context

The UAE has a very effective legal framework for combating money laundering: the two fundamental laws are

- Federal Decree-Law No. 20 of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT)

- Cabinet Decision No. 10 of 2019 (Implementing Regulation)

Additional AML oversight comes from:

- The Ministry of Economy (MoE)

- The Financial Intelligence Unit (FIU).

- The Financial Action Task Force (FATF) guidelines

- Sector regulators including DED and Dubai Land Department (DLD)

Real estate agents, brokers, and developers fall into the category of Designated Non-Financial Businesses and Professions (DNFBPs).

This means they must:

- Verify clients before any property transaction.

- Identify the Ultimate Beneficial Owner – UBO

- Apply a risk-based approach

- Monitor unusual or high-risk transactions

- Report suspicious activity on the goAML platform

- Keep records for at least 5 years

Failure to comply can lead to huge fines, cancellation of licences, and severe legal consequences.

Why AML Matters for Real Estate Professionals?

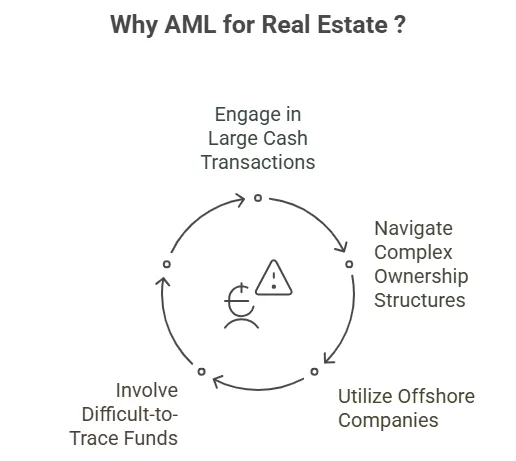

Real estate is one of the most attractive sectors for money launderers. Properties can be bought:

- With large amounts of cash

- Through complicated ownership structures

- Using offshore companies

- Using funds that are difficult to trace

Many criminals sell and buy property in order to turn illegal money into legally recognisable profit.

For real estate professionals, AML matters because:

- It is a legal requirement under UAE law.

- Failure to comply may lead to financial penalties, licence suspension, or even criminal charges.

- It protects the company’s reputation and prevents unintentional involvement in criminal activity.

- It enhances transparency and builds trust with foreign investors.

How Money Laundering in Real Estate Takes Place ?

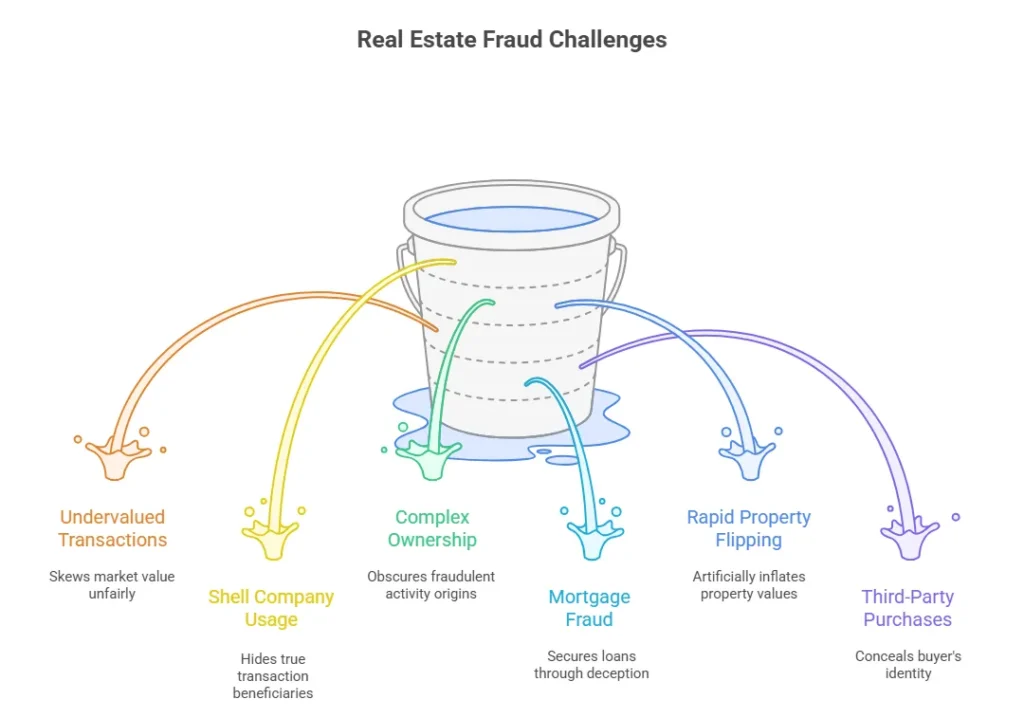

Real estate can be utilized for laundering in several ways:

- Purchases Made in Cash

Large cash payments make the tracing of sources very difficult.

- Undervalued or Overvalued Transactions

Such properties can be undervalued for concealing illicit funds or overvalued to create fictitious profits.

- Utilization of Shell Companies

Criminals use companies with no real operations to hide ownership.

- Complex Ownership Structures

Trusts, offshore companies, and multi-layered structures conceal the true UBO.

- Mortgage Fraud

Criminals use forged income documents or even conspire with third parties.

- Flipping Properties Rapidly

Buying and selling quickly to move large sums through the system.

- Purchases Made Through Third Parties

Using someone else’s name to distance the criminal from the transaction.

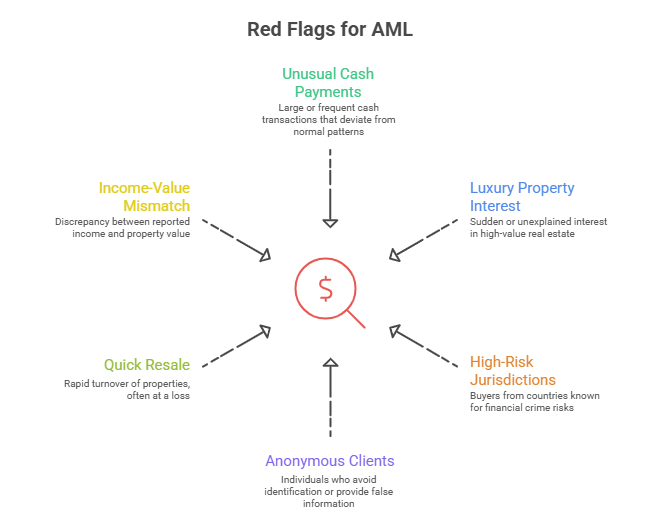

Red Flags that require attention:

- Unusual cash payments

- Sudden interest in luxury properties

- Buyers from high-risk jurisdictions

- Clients who refuse to identify themselves

- Quick resale of property

- Income and value of property mismatch

Why AML Is Important for The Real Estate Sector In Dubai ?

- The real estate market in Dubai is known all over the world for its:

- High-value transactions

- International buyers

- Cross-border flow of funds

- Rapid property growth

Due to these factors, the UAE government has enhanced AML controls to:

- Safeguard market integrity

- Prevent illicit funds from entering the market

- Comply with FATF standards

- Maintain the reputation of the UAE as a stable and transparent economy.

- Reduce risk of criminal abuse in property deals

Real estate companies must ensure strict adherence to compliances, including:

- Customer Due Diligence

- Source of funds verification

- Reporting suspicious activity

- Maintaining proper records

- Ensuring that ownership structures are legitimate

Why the Real Estate Sector is High-Risk ?

The factors that have made the real estate sector high-risk include:

- High-value transactions

- Attractive returns

- Use of foreign buyers and cross-border payments

- Shell companies and offshore entities

- Hidden UBOs

- Complex ownership structures

- International transfer of funds

Because of these vulnerabilities, real estate is usually targeted by criminals looking to camouflage illegal money.

What are the Best Practices for AML Compliance in the Real Estate Market ?

Real estate firms in the UAE should have a strong standard of compliance to reduce the risk of dealing in illegal funds. Good practices include:

- Risk-Based Approach

Each client and transaction need to be monitored according to the level of risk. Stronger checks are required for high-risk clients.

- Appointment of a Compliance Officer

It should be under the control of a trained officer who must review the documents, train the staff, and report any concerns about AML/CFT.

- Strong Internal Controls

Companies should establish an AML policy manual covering:

- Internal procedures

- Customer verification

- Transaction monitoring

- Escalation steps

- Reporting through the goAML system

- Customer Due Diligence (CDD)

Real estate agents, developers and brokers must:

- Verify Identities

- Check Know Your Customer (KYC) details

- Identify the Ultimate Beneficial Owner – UBO

- Understand the source of funds

- Apply Enhanced Due Diligence (EDD) for high-risk clients

- Record-Keeping

All documents, IDs, contracts, payment receipts, CDD files, should be archived for at least five years.

- Mandatory Reporting

Companies must submit the following:

- Suspicious Transaction Reports (STRs)

- Suspicious Activity Reports (SARs)

- Real Estate Activity Reports (REARs)

through the UAE Financial Intelligence Unit (FIU).

How AML Regulations Affect Foreign Investors ?

Foreign investors are a significant part of the UAE real estate market. AML rules make the market safer by ensuring:

- Transparency

- Verification of funds overseas

- Protection from financial crime

Foreign buyers may be subjected to:

- Additional checks if considered to be PEPs

- Extra documentation when dealing through offshore companies or trusts

- Confirmation of legitimate source of funds

- Compliance with UAE reporting requirements

These steps also help to maintain confidence in the UAE as a stable and well-regulated market.

AML Compliance: Why It Is Important in UAE Real Estate ?

Adherence to AML rules is not optional-it’s obligatory. Non-compliant real estate firms may be exposed to the following:

- Heavy financial penalties

- Licence suspension or revocation

- Criminal liability, including possible imprisonment

- Serious reputational damage

For professionals like agents, brokers, and developers, AML compliance ensures:

- Safer transactions

- Protection from high-risk clients

- Stronger investor trust

- A healthier and more transparent industry

How MOJ AML and Real Estate AML Are Linked ?

AML legislation concerning real estate involves several ministries and authorities:

- The UAE Ministry of Justice (MOJ)

- The Ministry of Economy (MoE)

- The Dubai Land Department (DLD)

These bodies work together to:

- Enforce federal AML/CFT laws

- Monitor suspicious property transactions

- Regulate property transfers

- Oversee the lawyers, notaries, and other legal consultants in property-related transactions

This coordination enhances the overall AML framework of the UAE.

AML Compliance Requirements for the Real Estate Sector in the UAE ?

The real estate sector was found to be more exposed to financial crimes. Among its key requirements are:

- Monitoring customers and transactions

- Reviewing the potential terrorist financing risks

- Understanding the customer profile

- Following AML/CFT provisions issued by the UAE

- Submitting suspicious reports in a timely manner

These rules are binding on all real estate agents, brokers, and developers because they fall within the ambit of DNFBPs.

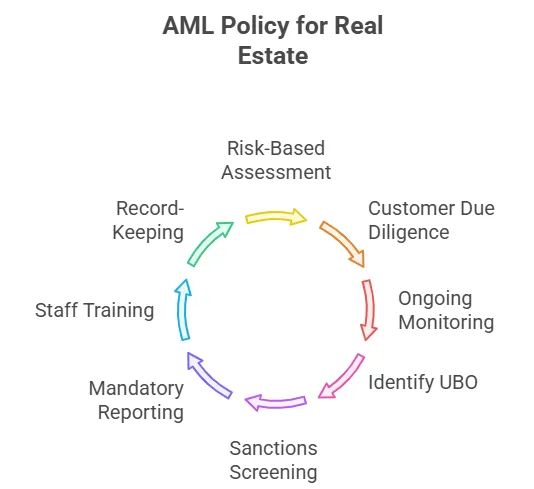

What is the AML Policy for Real Estate in UAE ?

According to Federal Decree-Law No. 20 of 2018 and Cabinet Decision No. 10 of 2019, a real estate AML policy must include:

- A risk-based assessment

- Customer Due Diligence

- Ongoing monitoring

- Identification of UBO

- Screening against sanctions lists

- Mandatory reporting through the goAML platform

- Internal staff training

- Record-keeping procedures

It aims to deter illicit financial activities in property transactions.

What Every Brokerage Needs to Know About AML ?

Brokerages have to recognize that AML compliance is:

- A legal responsibility

- Required for all high-value transactions

- Critical for avoiding fines and penalties

- Necessary for protecting the firm’s licence

Regulations apply to:

- Real estate brokers

- Developers

- Property managers

- Sales agents

The regulations brought in by the Ministry of Economy and FIU help companies to cut down the risks associated with money laundering and terrorist financing.

What is the AML Regulation for Real Estate Sector in UAE ?

The UAE AML framework for real estate includes:

- Decree-Law No. 20 of 2018 – AML/CFT Law

- Cabinet Decision No. 10 of 2019 (Implementing Regulation

Requirements cover:

- Customer Due Diligence (CDD)

- Detection of suspicious behaviour

- Monitoring and reporting ML/FT activities

- Screening clients against sanctions lists

These will help protect the national economy and keep the investment environment clean.

What is Anti-Money Laundering Audit ?

An AML audit is an independent review of a company’s AML program. It checks whether:

- AML policies and procedures are effective.

- Staff follow compliance steps

- The company meets all legal requirements

- Any weaknesses or gaps exist?

Common components of an audit include:

- Risk assessment

- CDD procedures

- Monitoring controls

- Training programs

- STR/SAR reporting

- Record-keeping systems

Who Performs the Audit And At What Frequency?

AML audits are performed by:

- Recognized Third-Party Firms

- Independent auditors

- Certified AML professionals

The frequency of audit depends upon the following factors:

- Regulatory requirements

- Company size

- Risk level

- Most firms’ complete audits on an annual or biennial basis.

Benefits include:

- Improved compliance

- Lower risk of fines

- Stronger reputation and trust

- Better operational controls

What are the AML Audit Services in Dubai ?

AML audit services usually include:

- Review of AML policies

- Internal control evaluation

- Customer onboarding and CDD testing

- Transaction monitoring review

- Staff interviews

- Sample testing

- Reporting findings

- Recommendations for improvement

Regulators such as:

- The Central Bank of the UAE

- The Dubai Financial Services Authority (DFSA).

- Free zone authorities

Require frequent AML monitoring for high-risk DNFBPs.

What are the List of major AML service providers in Dubai ?

A combination of audit firms, consultancies, and specialized compliance providers supplement Dubai’s AML regime with independent AML reviews, CDD assessments, risk ratings, and the implementation of AML/CFT programs.

Below are the main categories of service providers operating in the UAE, together with examples commonly known across the market.

- Global audit & consulting firms offering AML services

These companies provide independent AML audits, policy reviews, and compliance assessments to real estate brokers, developers, and other DNFBPs.

Examples include:

Big Four Audit Firms (commonly operating in Dubai):

- Deloitte – Known for anti-money laundering compliance audits, risk advisory, and financial crime reviews.

- EY-Ernst & Young: Provides AML/CFT assessments and forensic reviews.

- KPMG: AML audits, regulatory compliance checks, and transaction monitoring reviews.

- PwC: Providing AML framework assessments, CFT compliance support.

Why they matter:

These companies are audited for global AML standards and also undergo local reviews in conformity with the UAE’s requirements, pursuant to Federal Decree-Law No. 20 of 2018 and Cabinet Decision No. 10 of 2019.

- Specialized AML & Financial Crime Consulting Firms

Particularly, these companies focus on AML/CFT, sanctions compliance, and risk assessments, especially in the field of DNFBPs related to real estate.

Examples include:

ACAMS-certified consultancies are those firms led by a specialist certified either by ACAMS or CAMS and whose services shall include AML policy drafting, CDD support, EDD checks, and goAML reporting.

Boutique AML consulting firms are those independently owned consultancies based in the UAE, offering bespoke AML frameworks to brokers, developers, property managers, and real estate agents.

Why they matter:

They offer services in providing risk-based AML programs, UBO verification, enhanced due diligence, and goAML filing guidance.

- UAE-registered audit firms approved for DNFBP AML reviews

Some of the UAE audit firms that have so far specialized in AML audits for DNFBPs include:

MOE-registered audit firms

DED-approved audit firms

Free zone-approved professional firms (DMCC, JAFZA, DAFZA among others)

Why they matter:

These firms are authorized to perform AML reviews necessary for DNFBPs and thereby assist businesses with their compliance in UAE AML laws.

- Technology & Compliance Solution Providers

These companies support compliance through:

KYC/CDD tools, Sanctions screening systems

Transaction monitoring systems

UBO verification software

goAML integration tools.

Examples commonly found in the UAE market include:

Refinitiv World-Check

LexisNexis Risk Solutions, and

Dow Jones Risk & Compliance Tools.

Why they matter:

They support AML teams in automating the screening, risk scoring, and monitoring that is so crucial in real estate DNFBPs.

- Law Firms with AML Advisory Practice

Many law firms in Dubai assist real estate companies with the following issues:

AML compliance reviews, regulatory guidance, documentation of AML policies, and legal interpretation of AML/CFT laws.

Why they matter:

They help organizations understand the underlying legal implications, regulatory penalties, and reporting requirements under UAE law.

Why Choose Farahat and Co AML Services ?

UAE-based real estate businesses are facing a host of new, intricate compliance requirements under Federal Decree-Law No. 20 of 2018 and Cabinet Decision No. 10 of 2019. Our AML team supports brokers, developers, property managers, and all DNFBPs in meeting their legal obligations.

Here’s how our services help:

- Full AML Compliance Setup

We help with:

– Developing internal AML/CFT policies

– Creating procedural manuals

– Setting up KYC and CDD workflows

– Building a risk-based approach to suit your business

- Customer Due Diligence (CDD)

We help real estate firms verify:

– Customer identity

– Ultimate Beneficial Owners – UBOs

– Source of funds

– High-risk client indicators

– Sanctions list screening

- Risk Assessment & Monitoring

Our team assesses:

– Transaction risks

– Client-side risks

– Geographic Risks

– Product/Service Risks

We design monitoring systems that are in compliance with UAE AML rules.

- goAML Registration & Reporting

We support companies with:

– Preparing Suspicious Transaction Reports (STRs)

– Filing Real Estate Activity Reports (REARs)

– Ensuring records meet FIU requirements

- Independent AML Audit

Specific audit services will be performed to determine if your AML framework is:

– Effective

– Legally compliant

– Updated with the most recent UAE rules

– We identify gaps and recommend improvements.

- Staff Training & Awareness

We train your team on:

– Red flags

– CDD checks UBO identification

– Reporting guidelines

– AML obligations for real estate DNFBPs

- Ongoing Compliance Support

We can offer monthly, quarterly, or annual support to ensure that your business remains fully compliant.

FAQ

What is anti-money laundering compliance?

It means all the measures that should be taken by the business in order to avoid the use of property transactions for illicit funds. It includes KYC, CDD, reporting, and record keeping.

What is AML, and why does it matter in real estate?

AML helps to protect the property market from being used for nefarious activities. Real estate involves high-value transactions and thus represents one of the prime targets for illicit funds.

How Does Money Laundering Happen in Real Estate?

The methods involve cash purchases, shell companies, undervalued/overvalued deals, structures of offshore ownership, and rapid resale of properties.

What are the AML requirements in the UAE that are applicable to real estate?

Accordingly, the UAE AML law requires them to perform KYC, CDD, send reports through the goAML system, identify UBO, retain records for five years, and monitor transactions.

Who is considered a DNFBP for the UAE real estate sector?

Real estate brokers, developers, agents, property managers and firms that are engaged in the sale or purchase of property.

Why does the UAE real estate sector hold a high risk with respect to money laundering?

This is due to the high-value transactions, foreign investors, structures for offshore ownership, and the involvement of intermediaries.

What is the role of CDD in AML for real estate?

It involves the verification of a customer’s identity, the ownership structure, and the source of funds before completion of the property transaction.

How frequently should AML audits for real estate companies in Dubai be conducted?

Commonly every 1–2 years depending upon the risk profile and regulatory requirements of the firm.

What does an AML audit of a real estate business include?

Review of AML policies, procedures, training, reporting systems, and overall compliance with UAE AML laws.

What are the penalties for failing to comply with AML regulations in the UAE?

These may come in the form of heavy fines, license suspension, license cancellations, and even criminal prosecutions.

How do foreign investors comply with AML while purchasing a property in Dubai?

They have to provide identification documents, proof of funds, and UBO details. Also, in case they are perceived to be high risk, they can be subjected to EDD.

How does MOJ AML relate to real estate AML?

MOJ cooperates with DLD and MoE in the implementation of AML laws along the whole chain of real estate transactions.

Why should real estate businesses select professional AML services in Dubai?

Comply fully and avoid the risk of penalties. License protection while gaining confidence in clients and regulators